The application monitors loan contracts. The key parameter for early warning is the probability of default calculated in a neuronal network (PD).

The PD is accompanied by the expected credit loss (ECL), also calculated in a neuronal network.

The PD triggers an early warning in case it exceeds entirely or its variance exceeds a specific threshold. The ECL helps to qualify the urgency of forbearance or modification.

Depending on the configuration in question, early monitoring can be a record in a watch list or task list.

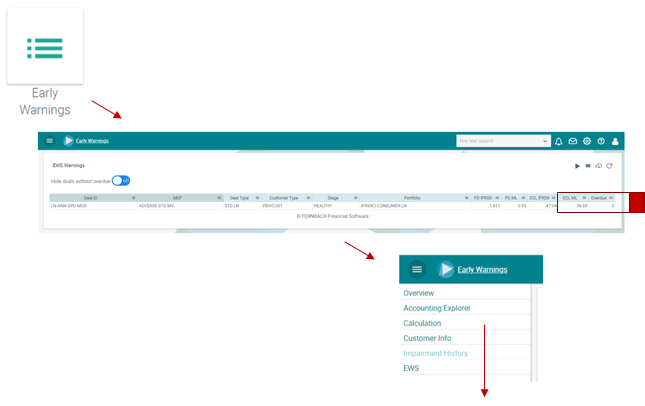

Figure: Early warning

The early warning view can be used for several purposes:

1. Identifying early warnings

Early warnings are listed in a watch list or task list. Filters can be set, e.g. the view can be limited to those deals with 'days past due > 0 or for combinations of thresholds for PD and ECL.

Workflows can be triggered that require specific actions in loan management (e.g. a specific work unit in the lending department receives a task to manage forbearance or modifications).

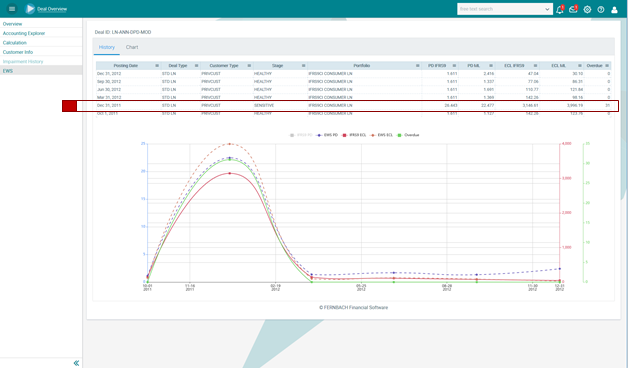

2. Period-based analysis

- identifies a trend for PD and ECL that might be relevant for the appropriate EWS action

- understands the impact of former modifications to PD and ECL

The conventional approach for early warning only often works with overdue payment dates (days past due). Then, unfortunately, it is often too late to modify and rescue the contract as the loan is usually already in default. At this point, the machine learning approach analyses the possible influences much more extensively and provides alerts before a payment date becomes overdue. In addition, machine learning takes into account not only customer and contract data but also macro- and microeconomic factors that naturally influence payment behaviour.

The EWS application initiates a workflow when certain events occur. The events could also be the variance of the ECL, for example. The workflow actions could also be linked to contract deadlines in such a way that realistic options for action also exist.

Conventional segmentation and staging is linked to conservative models to derive PD, LGD at portfolio level and to calculate ECLs for regulatory purposes. Calibration is „manual work“ and hence a source of errors. The prediction accuracy depends directly on the quality of the manual work during segmentation and calibration. This approach might not be sufficient for the very fine-granular decision of an early warning system. If in this case, specific actions should be triggered at individual customer level to reduce potential future losses caused by deterioration in credit quality, a more finely granular analysis is recommended that takes the specific sensitivity of an entity/customer relation into account.

Therefore, an EWS should apply machine learning to identify comparable transactions that have ultimatley failed in the past after showing a deterioration in credit quality.