Highlights:

|

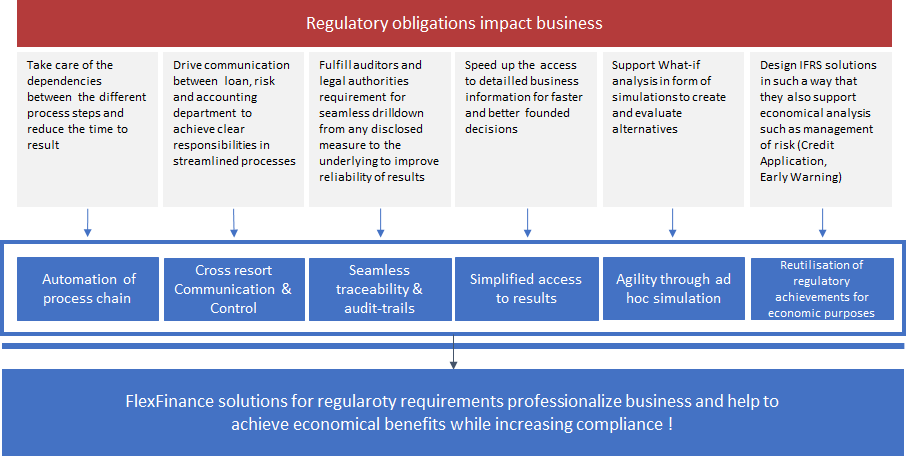

Regulatory obligations impact business in various ways. For compliance purposes, business processes need to be adjusted and new control mechanisms need to be implemented. While supporting compliance as well as the necessary processes, FlexFinance helps to professionalise business and achieve economic benefits.

Figure: FlexFinance helps to achieve economic benefits by fulfilling regulatory obligations

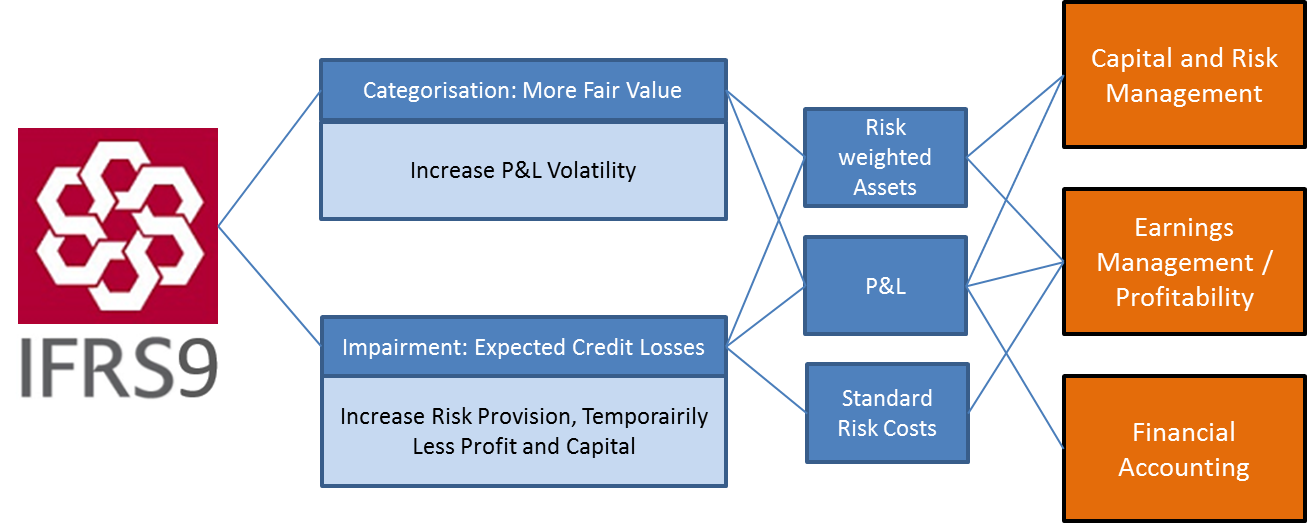

For example, IFRS 9 calls for the implementation of complex and challenging new regulations on risk provisioning (impairment). Of course the introduction of the expected credit loss model does not impact the payment behaviour of customers itself. The sum of the net payments for a financial instrument does not depend on the GAAP applied. However, IFRS 9 regulates the profit and loss to be disclosed at a certain point in time during the life cycle of a financial instrument. This time factor impacts profit and loss, risk-weighted assets and standard risk costs. In consequence, this time factor ultimately impacts overall bank management, including capital and risk management, regulatory reporting, management of earnings and financial accounting.

Figure: IFRS 9 impacts core elements of overall bank management

The expected credit loss (ECL) for an existing transaction is calculated during regulatory analysis and posted to risk provisioning with an immediate effect on income. When ECL expectations later become reality, the provision for credit risks is written back at the expense of a write-down without any impact on the P&L at this point in time.

On the other hand, an attempt is made from an economic point of view, to limit the "feared" credit loss operationally and to start with the loan application or to integrate it into credit management as an early warning system. From a business perspective, it is all about credit risk and how to consider it in:

- Loan application:

- Key question: How much credit risk can/should the bank take?

- The consumption of regulatory capital prior to contract conclusion should be taken into account for the decision on the loan application.

- Credit risk adjusted pricing:

- Key question: The "price" (interest) for a loan consists of various elements such as risk-free interest, a margin and the credit spread. In the event that the actual credit spread should not or cannot be covered by other price-components, what is the appropriate credit spread that covers the lifetime expected credit losses?

- Early warning:

- Key question: When should a certain type of activity be triggered if the actual occurrence of a credit loss threatens? Based on experiences made in the past, what forbearance or modification is needed to best avoid foreclosure for the customer DNA in question? How can the right time to take any action be determined?

The regulatory ECL, as well as parameters used while calculating ECLs, can be reused in an economic business environment.

But with regard to ...

- Staging

IFRS 9 differentiates between 3 stages depending on the significance of the deterioration in credit quality. Depending on the stage assigned, IFRS 9 calls for the consideration of 12-month or lifetime ECLs.

As far as early warning is concerned, the differentiation between the 3 stages does not have a sufficient degree of fine granularity. For example, it makes a difference in the probability of default from the perspective of the individual deal if a retail customer is delayed with a due payment for 5 days, 2 weeks or even 4 weeks. Even the probability of success of forbearance or modification measures depends on the right timing which is not necessarily provided by regulatory approaches. - Segmentation

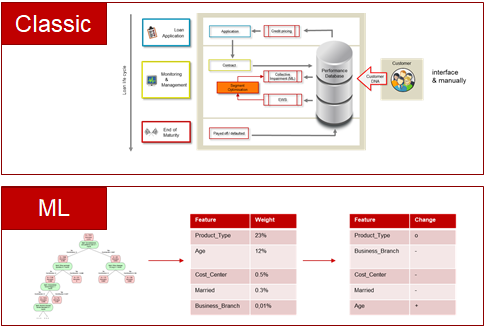

Conventional approaches work with a rule-based segmentation, applying manually captured settings to identify similar credit risk characteristics using an excerpt of the customer DNA and some product and deal-specific parameters. The calculation of lifetime expected credit losses using parameters based on portfolio/segment, defined using high level similar credit risk characteristics, is fine. However, e.g. for significant deals, the use of regulatory segments to decide on a credit risk adjusted price is questionable. Due to the rough granularity of segments, an entity might not make a deal because the interest offered was too high or it might conclude a deal where the interest does not cover the credit risk.

Figure: Segmentation in the conventional approach and machine learning

Macroeconomic parameters

Macroeconomic parameters are forecasted separately in the conventional approach. Then the parameter forecasted is used as input for the Roll Rate or Migration Analysis.

In the machine learning approach, the forecast of the macroeconomic parameter is integrated into the machine learning process of the neuronal network.

Conventional approaches are sufficient and accepted for regulatory requirements. Of course, they can also be generally used for business analysis. |

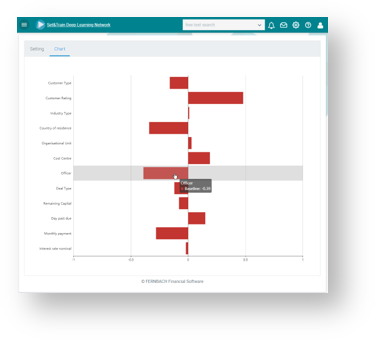

Figure: Making use of the entire customer DNA in a neuronal network