In the section "Core Valuation: Effective Interest Rate" the mathematical formular, challenges in calculation as well as the splitting of the EIR in various elements is explained in general.

According to IFRS9 "Appendix A Defined Terms", the computation of the effective interest rate shall be based on the expected cash flows of the financial instrument. The estimate of expected cash flows

- shall consider all the contractual terms of the financial instrument, including but not limited to

- early repayment rights,

- calls,

- extensions

- and similar options

- but shall not consider the expected credit losses.

The calculation includes all

- premiums, discounts and upfront payments

- transaction costs

- forward adjustments

- costs of embedded separated from the host contract

- hedge adjustments at the termination of a hedge relationship

- initial basis adjustments for late hedges

- unwinding of the impairment adjustment

In general, the amortisation period is linked to the lifetime of the financial instrument. However, as described in IFRS9 B5.5.4, if a fee is only related to a shorter period, it shall be amortised over this period only.

For example, in the case of a financial instrument with a floating rate, the transaction price may contain premiums/discounts that reflect the current market situation. Hence, the premiums/discounts related to the current market rate shall be amortised only over the current fixing period. Instead, if the premiums/discounts are linked to a change in credit spread or other variables that are not related to the market rate, it shall be amortised over the lifetime of the financial instrument.

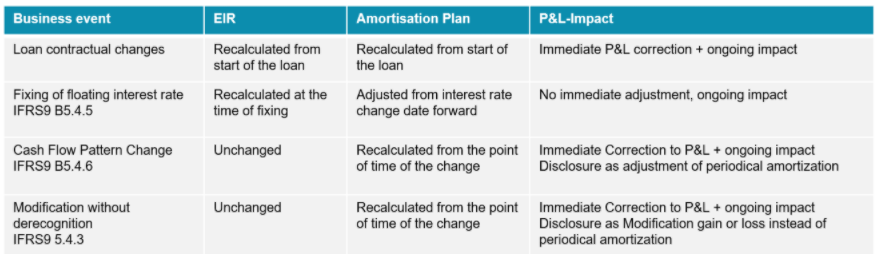

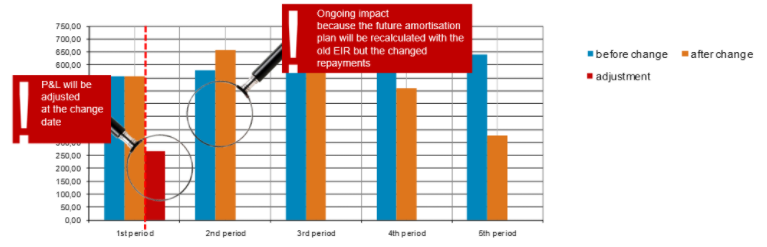

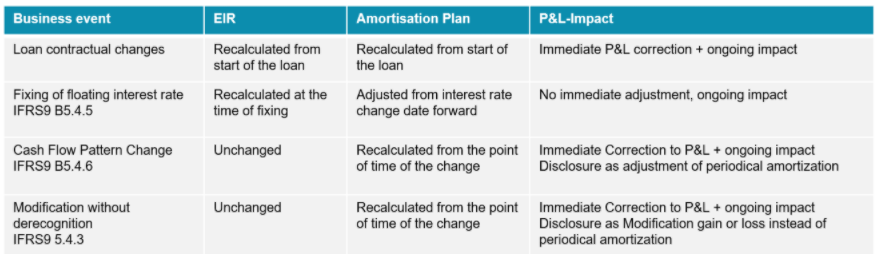

Depending on the type of business event, the EIR, the amortisation plan and the P&L are impacted differently.

The solution is able to identifiy the business event and to initiate the appropriate action.

By detecting a change in the contractual deal data that are delivered, the solution automatically triggers a recalculation of the EIR and/or adjustment of the amortisation plan according to IFRS9, including but not limited to:

For IFRS, the impact of changes in deal data are considered like following:

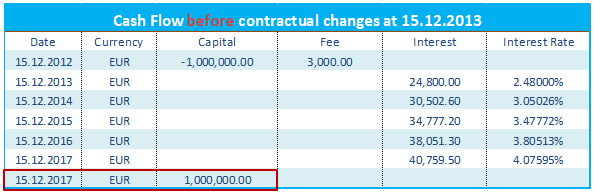

Loan Contractual Changes

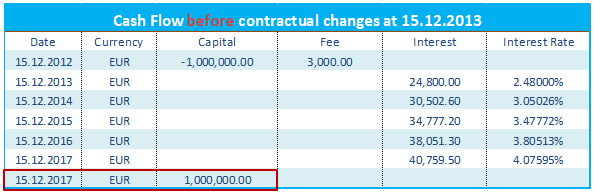

Scenario: The contractual payment plan for a loan is restructured.

For example, let us consider that the original cash flow plan for a deal is as follows:

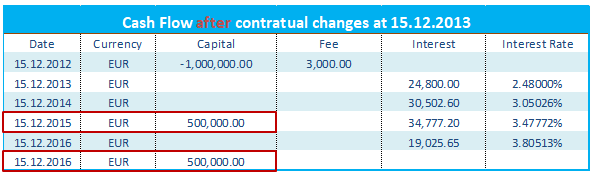

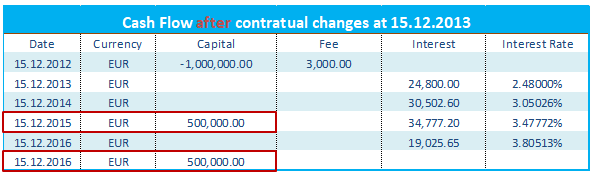

and that the revised cash flow plan for the deal after restructuring is as follows:

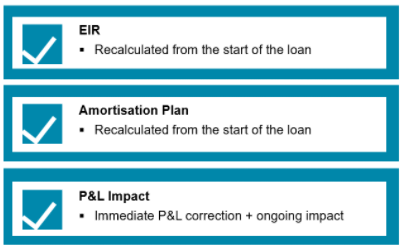

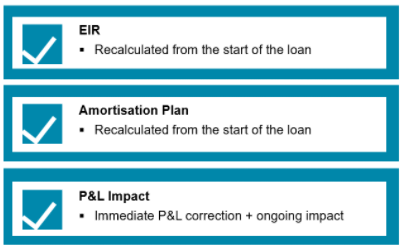

The impacts of this change on the EIR, the amortisation plan and the P&L are as follows:

The effects on the amortisation of the fee are as follows:

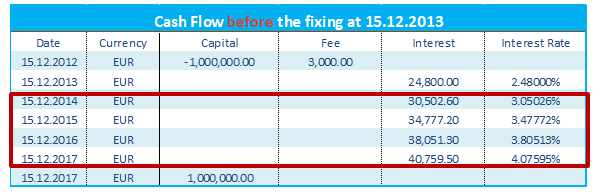

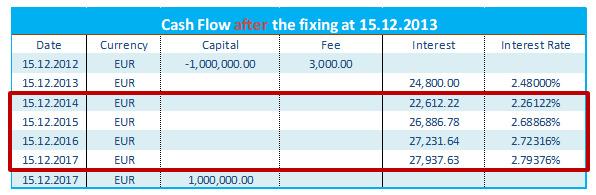

Fixing of Floating Interest Rates

Scenario: Changes in interest cash flows for a floating deal (the interest rate of the deal is reset).

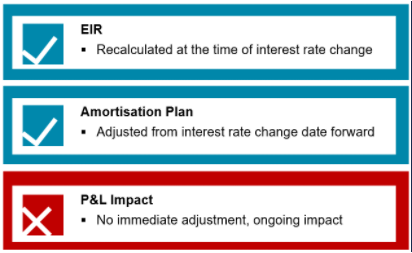

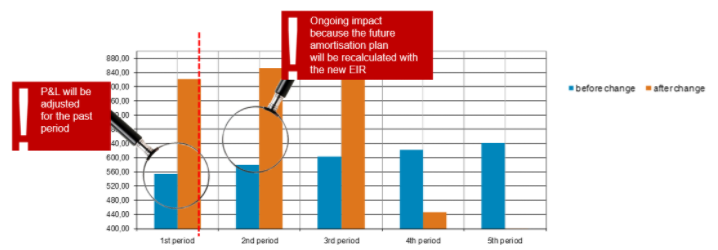

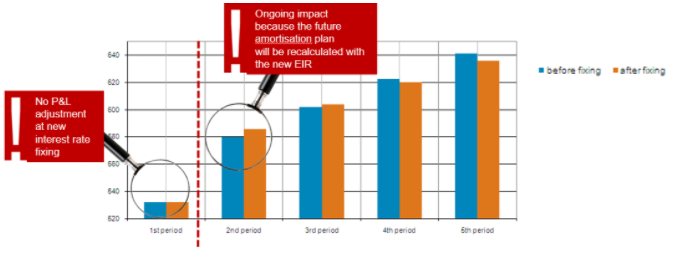

IFRS9 has specific requirements for this scenario: In the case of a financial instrument with a floating interest rate, the EIR should be periodically adjusted to reflect the latest market conditions in accordance with IFRS9 B5.4.5. The recalculation of the EIR has no immediate impact on profit and loss but the future amortisation plan should be adjusted on the basis of the revised EIR.

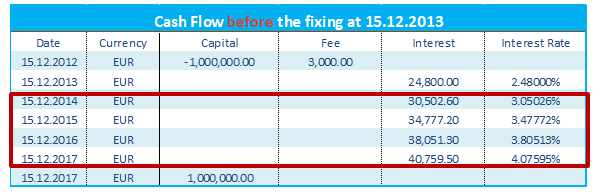

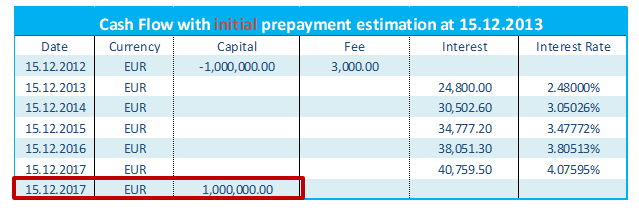

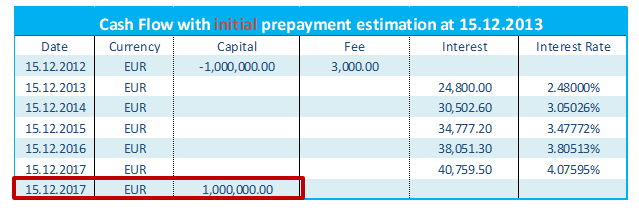

For example, let us consider that the original cash flow plan for a deal is as follows:

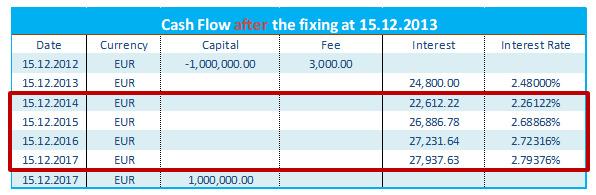

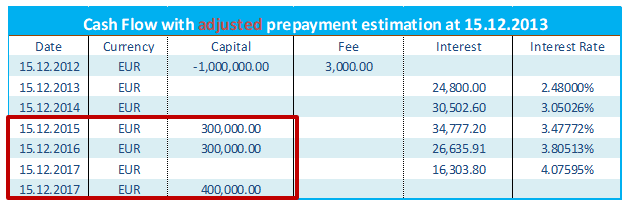

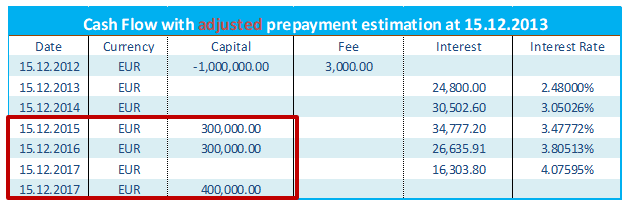

and that the revised cash flow plan for the deal after interest rate fixing is as follows:

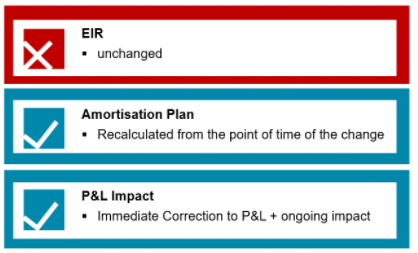

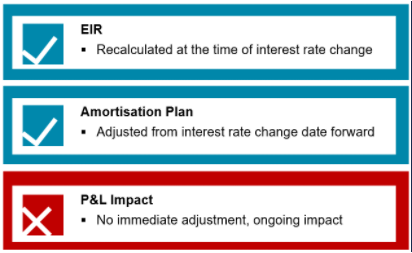

The impacts of this change on the EIR, the amortisation plan and the P&L are as follows:

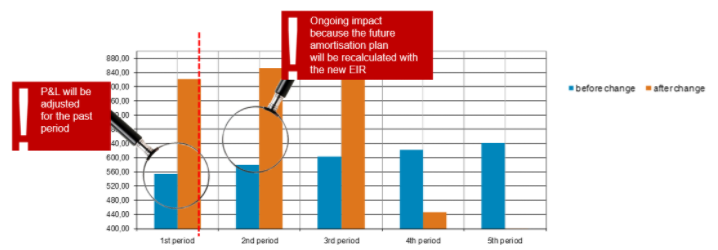

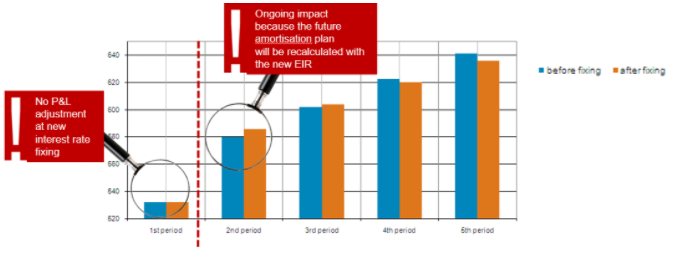

The effects on the amortisation of the fee are as follows:

Cash Flow Pattern Changes

Scenario: The expected future cash flows change.

For example, let us consider that the original cash flow plan for a deal is as follows

and that the revised cash flow plan for the deal after the change is as follows

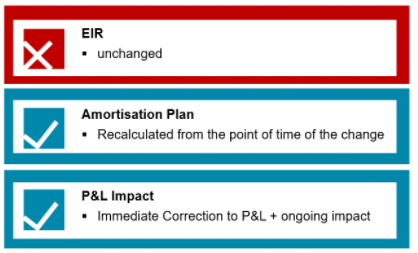

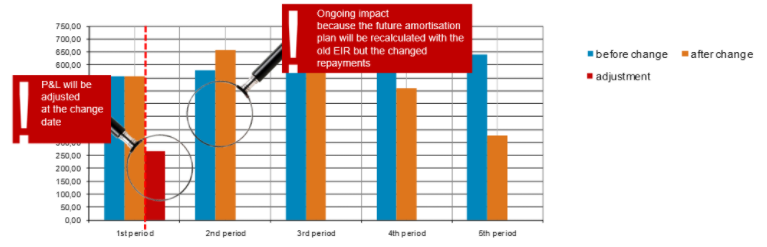

The impacts of this change on the EIR, the amortisation plan and the P&L are as follows:

The effects on the amortisation of the fee are as follows:

Modification

The term "modification" in accordance with IFRS9.5.4.3 relates to adjustments to the contractual cash flows for financial assets.

A modification is an adaptation of the terms of the contract, whereby the nature and scope of a modification determines the accounting consequences.

A modification can occur due to various reasons including but not limited to a customer's financial difficulties.

The following modifications to contractual agreements might have an impact on the estimated cash flow plan. They need to be considered as “Modification” in the solution:

- change of maturity date for the individual deal

- change of repayment schedule

- change of interest agreements (change of fixed rate, change of fixing rules, change of pay)

The following cases are not to be considered as “modification of contractual data” within the scope of IFRS 9.5.4.3:

- new fixing of the interest rate for a floater (IFRS9 B5.4.5)

- “capital withdrawing” (IFRS9 Appendix A)

- “hedge adjustment” for hedged items in accounting category AC (IFRS9 6.5.10)

- “discontinuation“ of credit risk hedges with credit default swaps (IFRS9 6.7.4)

- “business model change” or reclassification (IFRS9 B5.6.2)

By means of a contract modification, a substantial change in the contractual components may lead to a derecognition of a financial asset and thus to a corresponding recording of a "new" financial asset or, on the other hand, to a continuation of the previous financial asset in so far as the deal has not substantially changed.

When moving from IAS 39 to IFRS 9, for “renegotiation or modification”, a “clearer” guideline has been provided for the modification of contractual terms.

- Modification without de-recognition:

In the case of a non-significant modification, which does not lead to a de-recognition of the deal, an additional paragraph is inserted in IFRS 9 for “Modification of financial assets” (IFRS 9 5.4.3). - Modification with de-recognition:

In the case of a significant modification, the original contract should be de-recognised and a new contract should be recognised (as initial recognition from accounting aspects).

If there is no derecognition of the financial asset as a result of the contract modification, the adjustment of the carrying value of the financial asset as a result of the modification is recognised as a modification gain or loss in profit or loss. The amount of this book value adjustment and the resultant modification result is determined as the difference between the book value of the modification and the modified contractual payment flows discounted with the original EIR.