Highlights:

|

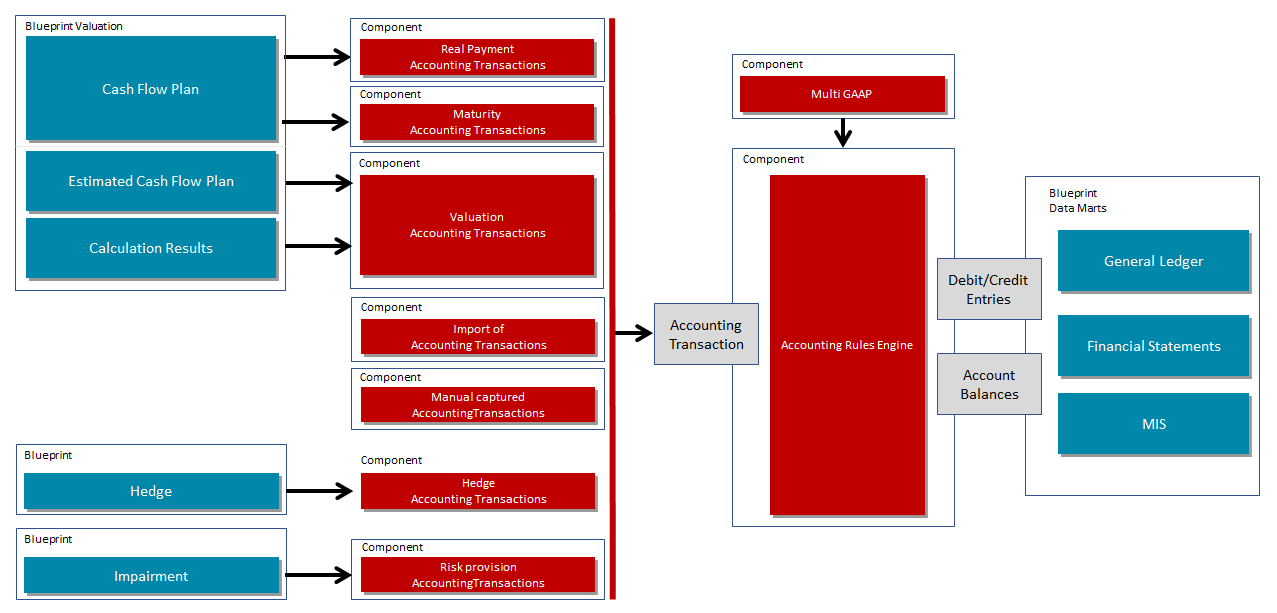

The blueprint Financial Accounting considers requirements for financial accounting, taking GAAP-specific requirements into account.

Main components are

- Components that identify accounting transactions and feed them into the Accounting Rules Engine.

- The blueprint focuses on an Accounting Rules Engine. It generates debit/credit entries in parallel GAAPs for the accounting transactions delivered. Individual settings can be defined for both the chart of accounts and the accounting logic. Hence for many GAAPs, templates are available that provide standard rule sets, accepted and approved in numerous projects world-wide.

A General Ledger that provides online access to balance sheets and income statements for multiple GAAPs and definable posting dates.

Data Marts that are the basis for financial statements, notes and a 360-degree analysis

The blueprint is also linked to core functions such as the Cash Flow Engine and the Result Layer. It uses the Estimated Cash Flow Plan for calculating the initial measurement and subsequent measurement of financial instruments. Results are provided in Data Marts for presentation and analysing purposes.

It can be used to cover a

- Full-size general ledger in parallel GAAPs, covering the entire portfolio of an entity including financial and non-financial instruments

- Shadow ledger for financial instruments or a portfolio of financial instruments, including the delivery of debit/credit entries to any third-party general ledger

- Shadow ledger that is limited to specific products and for specific valuation elements.

For details on how to access the Balance Sheet and Income Statement in a specific GAAP, how to maintain the accounting logic and how to analyse financial accounting by drilldown and breakdown at individual transaction level, please read more in the manual: Swim Lane Financial Accounting.

The blueprint Financial Accounting supports

- Multiple GAAPs

- Multiple currencies

- Multiple companies (multi-tenant)

Figure: Blueprint Financial Accounting

For each GAAP FlexFinance offers the entire process chain for financial accounting, including

- Classification and Valuation, covering the calculation of GAAP-specific values for initial and subsequent measurement, refer to process chain for initial and subsequent measurement

- Hedge Accounting

- Risk Provision, including segmentation of financial assets with similar credit risk characteristics, stage assignment, calculation of GAAP-specific credit losses, refer to Workbenches for risk provisioning.

- Analysing and presentation of results, refer to Data Marts, Analysis and Reports for Financial Accounting.