Highlights:

|

The blueprint Financial Accounting contains a general ledger.

This general ledger supports multiple GAAPs in parallel. For each GAAP it can be decided if the implementation should cover a

- Full-size general ledger

- Shadow ledger or

- Shadow ledger light.

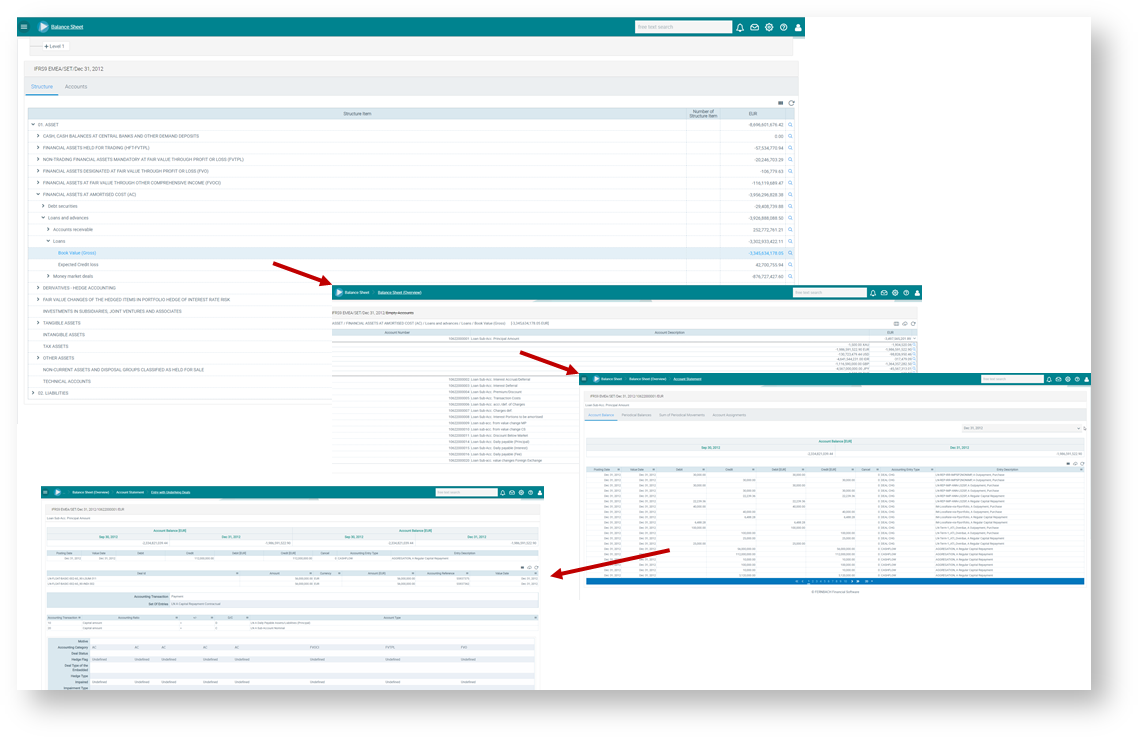

Figure: Drilldown from general ledger account balance

A full size general ledger considers for balance sheet and profit and loss:

- All financial instruments and

- All non-financial instruments as well as

- All valuation elements

As such, a full-size general ledger reflects the entire business of an entity.

It provides specific general ledger functionalities such as

- valuation of account balances in FX and posting of the related FX result

- profit and loss zeroisation at the end of a configurable fiscal period

Beside comprehensive financial statements, the functionality includes the support of analysing, reporting and presentation requirements.

A shadow ledger concentrates on an excerpt of the business of an entity. This excerpt can be for example "All financial instruments" or a "Loan Ledger".

A shadow ledger light is similar to the shadow ledger, but the focus is limited to specific valuation elements. For example a shadow ledger light might cover the amortisation of transaction costs for a loan portfolio as well as fair value specific valuation elements or risk provisioning.

The decision which implementation type of a general ledger in FlexFinance fits best should include the following aspects:

- No third-party general ledger is in place

- A third-party general ledger is in place, but

- does not support the drilldown of general ledger account balances to individual deal level (often third-party general ledgers work at aggregated level only)

- does not support the breakdown of account balances to freely definable portfolios (often third-party general ledgers are limted to 3 to 5 criteira which can be used for drilldown)

In any implmentation scenario, it is possible to export debit/credit entries to a third-party tool.