Highlights:

|

The blueprint Financial Accounting contains a general ledger.

This general ledger supports multiple GAAPs in parallel.

For each GAAP it can be decided if the implementation should cover a

- Full-size general ledger

- Shadow ledger or

- Shadow ledger light.

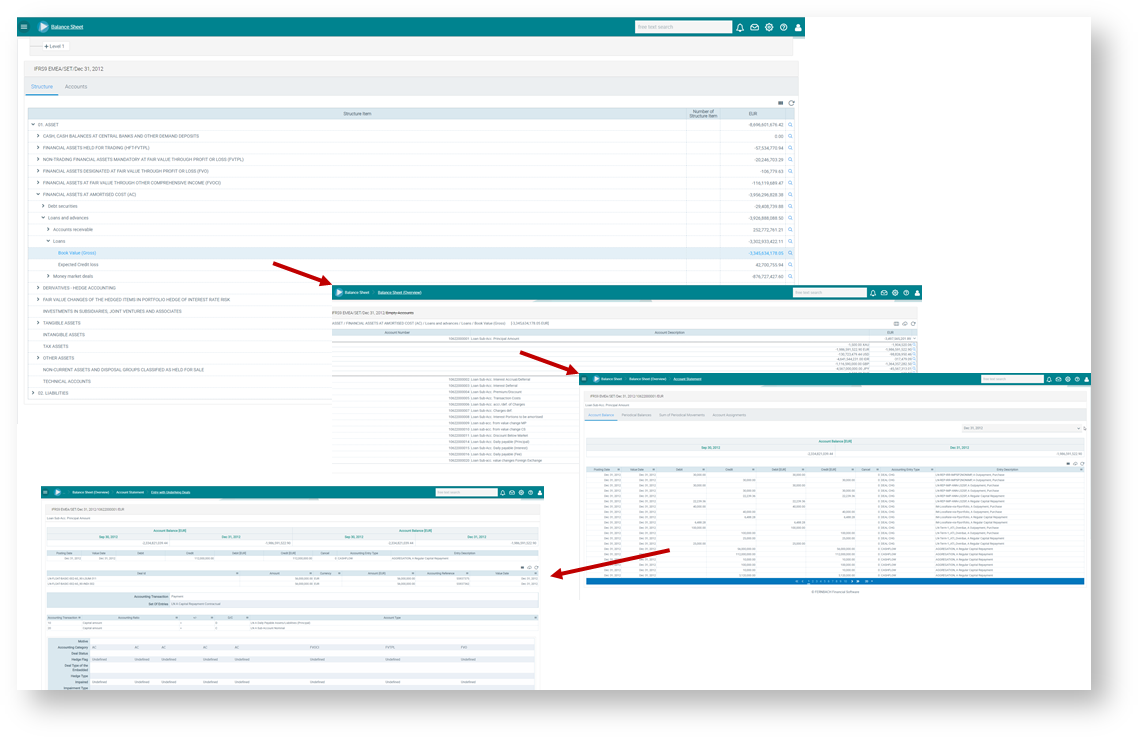

Figure: Drilldown from general ledger account balance

A General Ledger consists of

- Balance Sheet

- Profit and Loss

- Chart of Accounts

It can deal with

- Multiple GAAPs in parallel (The General Ledger contains a separate chart of accounts for each GAAP)

- Multiple tennants (The General Ledger supports consolidated views)

- Multiple currencies (The General Ledger keeps all bookings in original transaction currency as well as in functional currency)

The General Ledger

- Allows analysis at account, product, customer, business and project level with results aggregated at account / cost center level.

- Allows more accurate and efficient product control as entries are made at detailed and consolidated levels.

- Enables easier automation of reconciliation with minimal manual intervention as detailed or transaction-based data can be tracked and analysed in multiple dimensions.

In a multi-GAAP environment, it is possible to run e.g. a full-size general ledger for IFRS and a shadow ledger light for local GAAP which focusses on the specific valuation elements for a specific portfolio.