Highlights of the blueprint:

|

The IFRS 9 valuation blueprint covers the entire functionality that is necessary to deal with the valuation requirements specific to IFRS 9 with regard to initial and subsequent measurement. It contains several components that generate estimated cash flows while taking several types of information such as contractual data, market rate sources and customer payment behaviour into account for the prediction of the future cash flow plan. Regardless of whether the estimated cash flow plan is generated by the solution or if is delivered by another source, components such as EIR calculation or fair value calculation produce the necessary valuation elements related to Amortised Cost (AC) and Fair Value (FV). As such, valuation elements are provided on a highly granular level, offering great analysing options based on a combination of granular valuation elements and descriptive deal data.

In general, IFRS9 calls for an entity to measure its financial instruments on the basis of amortised cost (AC) or fair value (FV), depending on the accounting category assigned.

There are different ways to calculate AC and FV for a deal:

For all approaches, the estimated future cash flow plan of a deal forms the basis for the calculation.

In the case of fair value calculations, the mark-to-model approach uses the discounted cash flow method for calculation.

For amortised cost calulations, the effective interest rate (EIR) is needed. According to IFRS9, "when calculating the effective interest rate, an entity shall estimate the estimated cash flows

- by considering all the contractual terms of the financial instrument (for example: prepayment, extension, call and similar options)

- but shall not consider the expected credit losses.”

The blueprint valuation consists of the following groups of components:

Cash flow generation

For details about cash flow generation, please refer to Core Cash Flow Generation

- Initial and subsequent measurement

For details about initial and subsequent measurment, please refer to Core Valuation

IFRS 9 valuation requirements can be split into the following functions:

- Cash Flow Plan Generation

- Effective Interest Rate Calculation

- Amortised Cost Calculation

- Fair Value Calculation

- Impairment Adjustment Calculation

Philosophy “Separation of valuation elements”

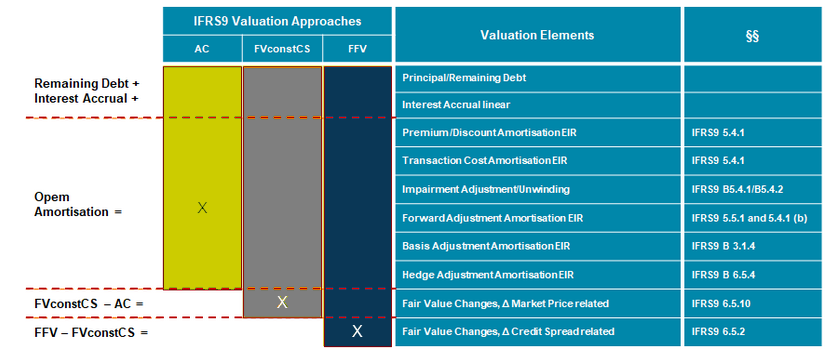

In the solution, instead of solely calculating THE Amortised Cost or THE Fair Value, these valuation approaches are split into valuation elements such as principal, outstanding amortisation of transaction costs, fair value changes related to changes in market price, etc.

Figure: Fine-granular valuation elements in the solution

Due to the provision of valuation elements combined with the fine-granular posting of each element, the solution ensures compliance and offers new perspectives:

- Solid basis for future reporting requirements

Example:

Regulator introduces the separate disclosure of credit spread related to fair value changes

- Fine-granular analysis of the balance sheet and income statement

Example Liquidity:

The differentiation within the AC valuation approach between paid interest, linear accrued interest in arrears and the amortisation of transaction costs enables a differentiation regarding the impact on liquidity:

'Which volumes in P&L impacted liquidity in the past, but will impact the income only in the future?' or 'Which volumes impact the income, but will have a liquidity impact only in the future?'

Example of the impact of changes in rating/credit spread for the income statement:

'How does the increasing credit spread for a specific group of customers impact the income statement?'

- Useful basis for the comparison of different GAAPs

Valuation elements which are unique over all GAAPs can be used for reconciliation between the different GAAPs.