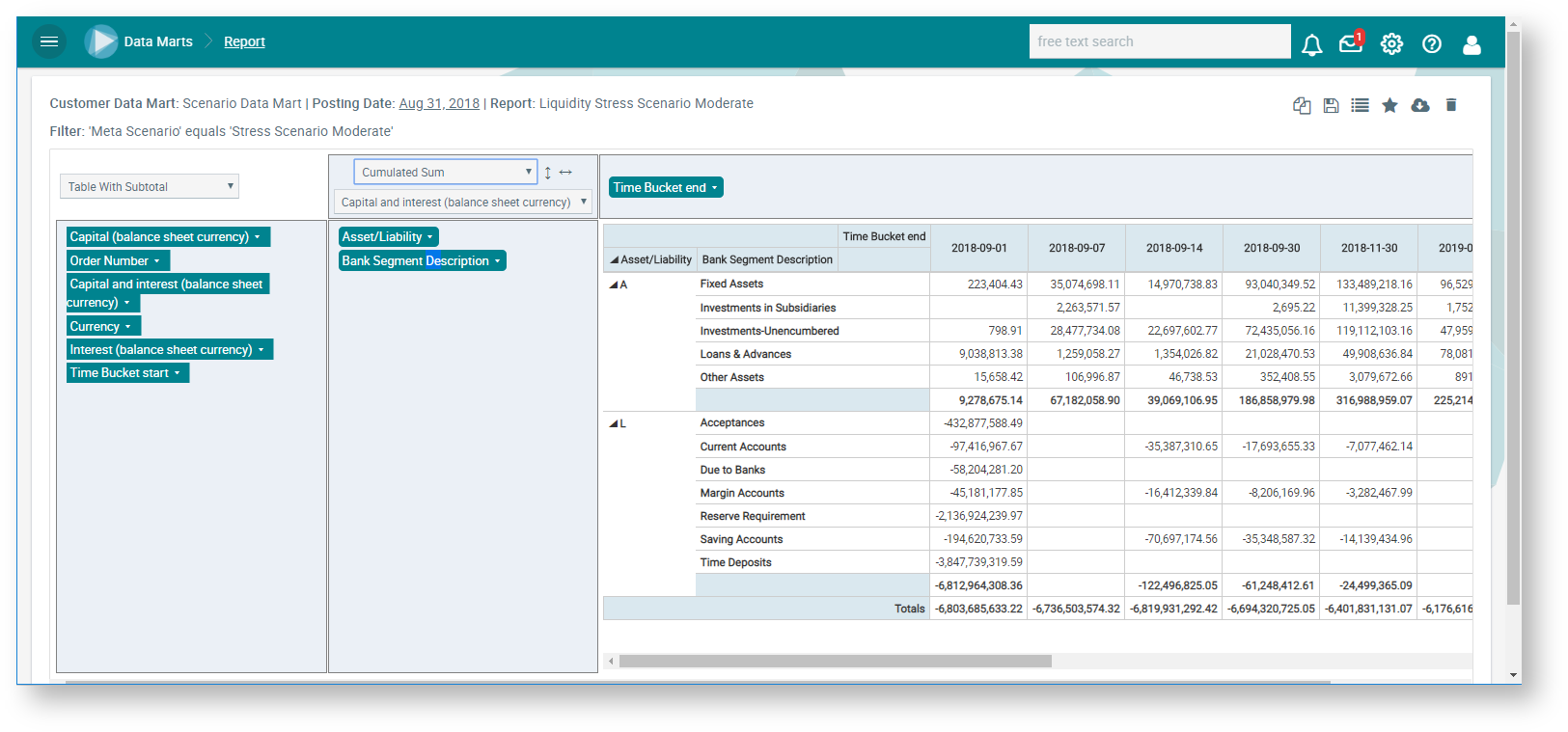

An analysis of the liquidity gap analysis is performed using various stress scenarios. In this case, the contractual cash flows for deals, securities positions and accounts are enhanced by scenarios that reflect possible individual developments in market data or customer behaviour. The following business scenarios are available for this purpose:

- Default scenarios (customers and individual payments)

- Payment deferral

- Expected volume of new business

- Premature payments (prepayments)

- Development of market data (interest rates and exchange rates)

- Counterbalancing capacity

These scenarios can be combined in any way. Various developments such as poor, moderate or good are presented in parallel in different reports. More information on the scenarios available can be found in Business Scenarios.