Financial assets assigned to stage 1 or stage 2 are processed in the Collective Impairment Workbench.

Processing is organised by the following structure:

- Expected Credit Loss models that are based mainly on the following parameters:

- PD models

- LGD models

- EAD models

- Economic scenarios

- Master scenarios

A model describes the determination method for a result value that is determined using mathematical methods or read from a configuration table.

If the model requires historical information for its calculation, a set of historical information such as performance data can be added to the model as a parameter.

A model can use various parameters for calculation, which in turn can be its own models. For example, the Expected Credit Loss model for loans is a stand-alone model that accesses PD, LGD, EAD, and macroeconomic parameters. PD, LGD and EAD are in turn separate models. For example a "PD model" can consist of a parameter "Mathematical Formular" and "Set of historical default information".

For the calculation of Expected Credit Loss for stage 1 and stage 2, the Collective Impairment Workbench supports:

- Analysis of performance data for PD point in time and LGD calculation

- Calculation of Exposure at Default (EAD)

- Calculation of probability-weighted Expected Credit Losses while taking various macroeconomic parameters in multiple scenarios into account

- Simulation as well as periodical processing

- Generation of journal entries

- Feeding a result layer that covers reporting requirements

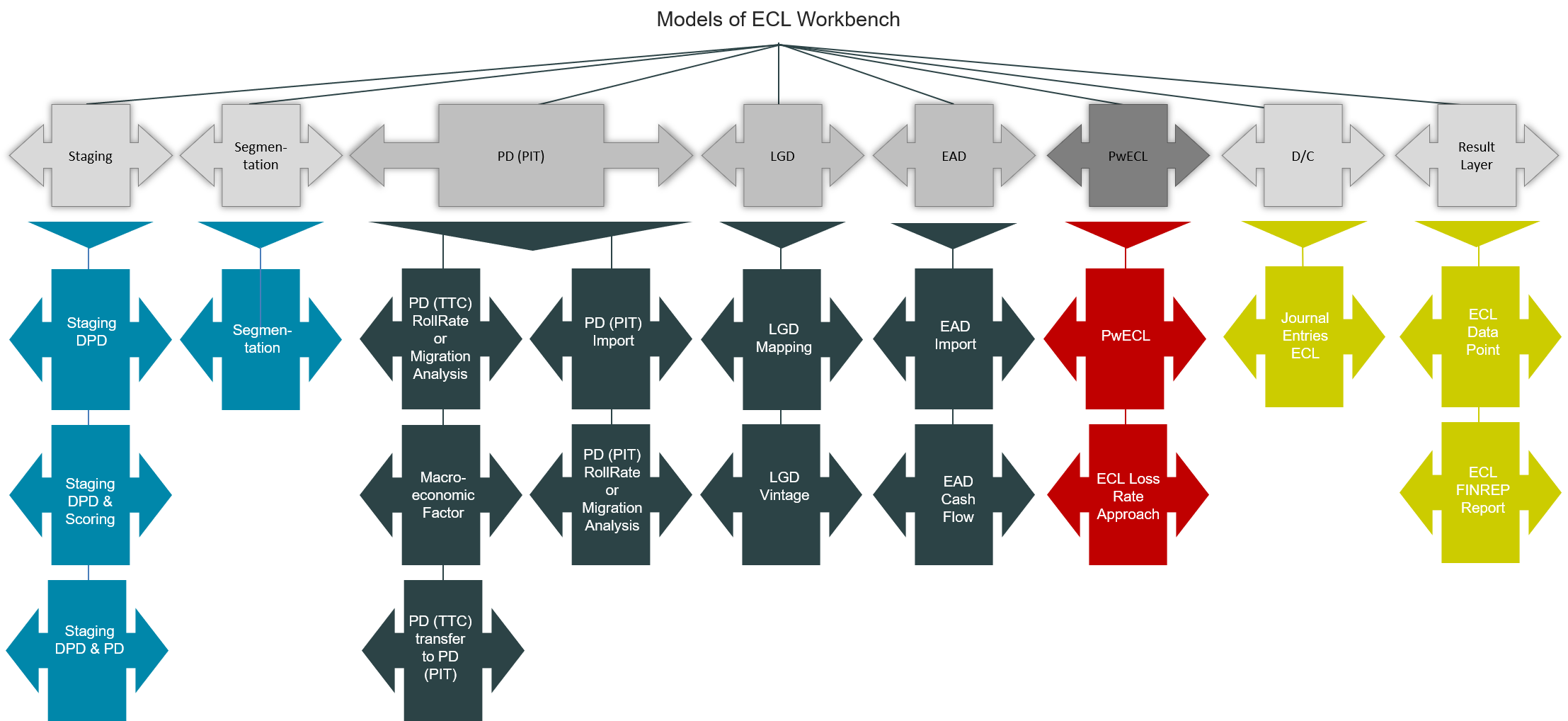

Wherever applications in the current IT landscape exist, the modular approach supports the recycling of measures already available. The process chain is designed in different steps. Each step has a clearly defined input/output interface. The modular approach provides various modules for each step in the process chain. Depending on available data and scope, a financial institution can select the appropriate module for each step.

The Expected Credit Loss Workbench is a construction kit that supports tailor-made solutions. These solutions can cover comprehensive approaches as well as simplified solutions, taking the complexity of an individual portfolio into account. The figure below shows the modules currently available for each step in the process chain. The number of modules increases frequently. Individual modules can be implemented without impact on the process chain itself.