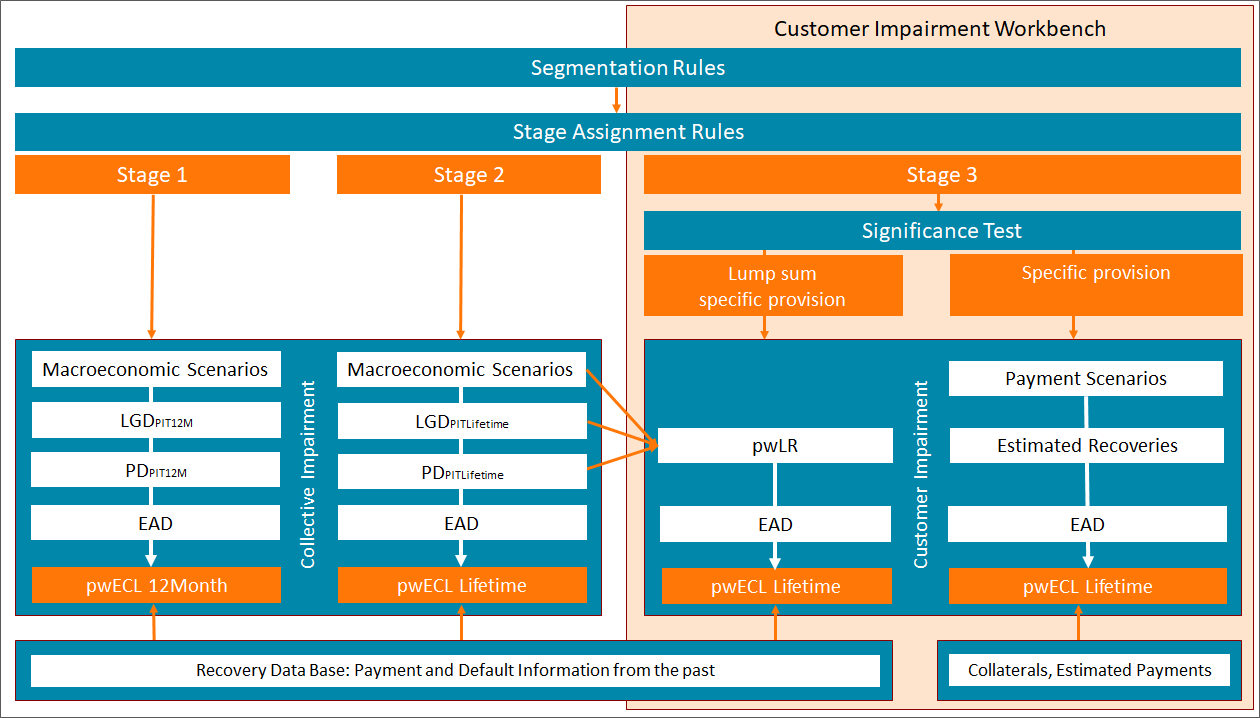

The component Customer Impairment Workbench can be used for

- Collateral management (refer to Collateral)

- For non-significant deals assigned the impairment type "Lump-sum Specific Provision": Calculation and journalisation of lifetime ECLs, taking collateral recoveries into account

- For significant deals assigned the impairment type "Specific Provision": Calculation and journalisation of lifetime ECLs, taking recoveries of collateral, regular and irregular recoveries into account

The Customer Impairment Workbench covers all requirements related to specific provision of significant financial assets and for lump-sum specific provisioning of non-significant financial assets.

The Customer Impairment Workbench needs to be fed in general on individual deal level with the following information

- Information about of objective evidence impairment. For this purpose FlexFinance supports the automatic identification based on rule sets, Import from a source as well as manual capture of impairment trigger in FlexFinance.

- Test of Significance

For lump sum specific provisioning of non-significant deals it expects the delivery of a probability weighted lossrate (pwLR). This pwLR can be provided by the Collective Impairment Workbench or imported from a source.

In general, the Customer Impairment Workbench provides fully automated support for significant and non-significant deals:

- Calculation of risk provision on the basis of lifetime expected credit losses:

- Automatic calculation of risk provisions comparing the actual gross carrying amount (GCA) and the sum of expected recoveries discounted with the original effective interest rate (EIR)

- Calculation of unwinding for subsequent measurement of impaired deals

- Analysis of calculation runs for specific risk provisions

- Access to calculation results for lifetime expected credit losses (ECL) at customer level, drilldown to individual deal level and to scenarios entered for recoveries

- Generation of journal entries at individual deal level:

- Generation of debit/credit entries to reflect risk provisions in the balance sheet and profit and loss account

- Generation of debit/credit entries to reflect risk provisions in the balance sheet and profit and loss account

In addition, the Customer Impairment Workbench supports for significant deals:

- Capture and maintenance of individual deal specific recovery data for significant deals:

- Recoveries from different sources are supported: In addition to collateral, irregular and regular recovery expectations about future payments can be captured and maintained

Recovery cashflows can be

- Automatically imported from a source

- Uploaded manually in the UI from a source

- Captured in the UI

- Automatically generated based on collateral data

- Probability-weighted scenarios support the consideration of various expectations about future payment behaviour of the custome

- Simulation of specific risk provisions

- For significant deals assigned to stage 3, calculation of risk provisions used to figure out how validity and allocation rules impact risk provisioning without posting

- For significant deals assigned to stage 3, calculation of risk provisions used to figure out how validity and allocation rules impact risk provisioning without posting

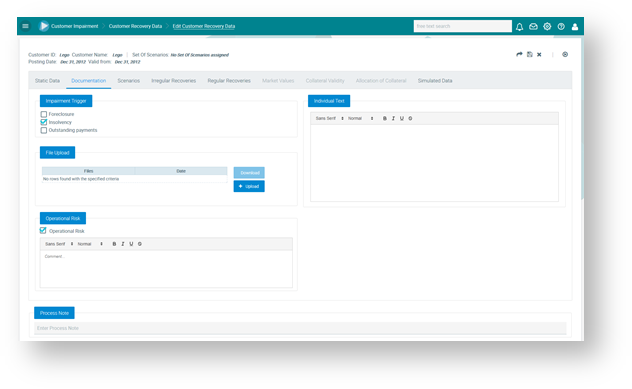

- Documentation of objective evidence of impairment for significant deals:

- Capture and maintenance of information on reasons for the objective evidence of impairment and related impairment triggers

- Addition of documents and individual notes

Figure: Customer Impairment Workbench: documentation of objective evidence for significant deals

- Support of organisational processes for significant deals:

- Intra- and inter-departmental processes can be organised using workflows and roles

- Process notes and notifications to simplify daily work

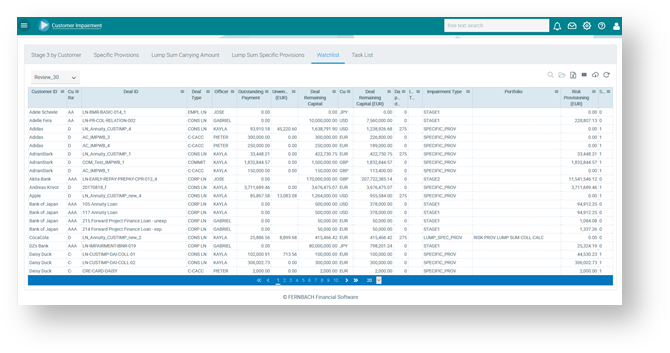

- Various watch lists can be configured to reflect the importance of following up a possible deterioration in the credit quality of portfolios of financial assets:

A watch list shows individual financial assets that are to be monitored closely.

A task list shows financial assets that are part of an active workflow.