FlexFinance provides data marts for reporting borrower statistics which are collected every quarter by the Deutsche Bundesbank.

The data mart contains the current remaining capital for all loans as of the reporting date, in which case the loans are differentiated according to:

- Remaining term divided into any maturity band ((e.g. < 1 year; 1-5 years, > 5 years)

- Companies or private individuals

- Sectors for corporate loans

- Type of loan (standard, acceptance credit or mortgage)

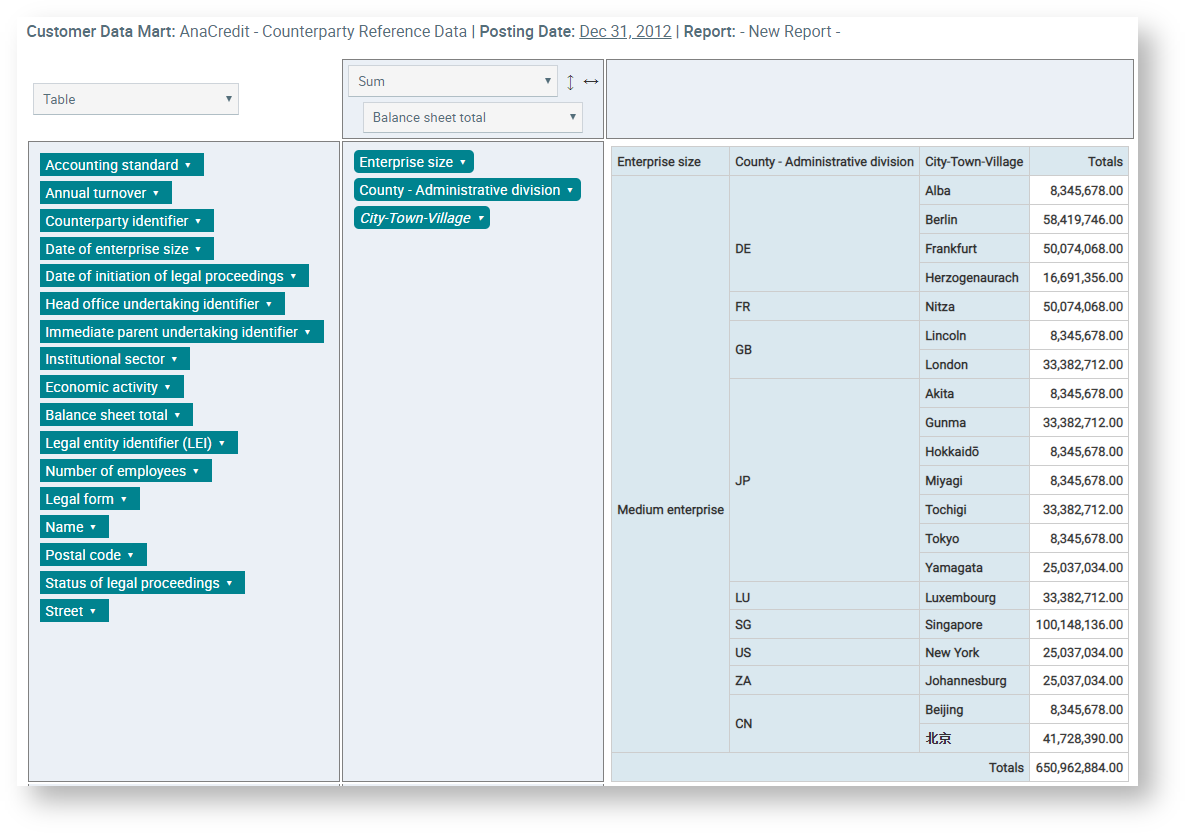

The same data marts can also be used for the reports based on AnaCredit (= Analytical Credit Datasets) which are called for by the national supervisory authorities and reported to the ECB (= European Central Bank). For this purpose, the data marts comprise more information, particularly for corporate loans. Some examples are given below:

- Information on counterparties

- Size

- Number of employees

- Counterparty’s balance sheet total

- Detailed information on individual loans

- Interest rate

- Collateral

- Outstanding payments

- Information on group structures or consortia

- Associated liabilities

- Information on deals in default

- Probability of default

- Default status

- Liquidised collateral

Below is an example of some customer information based on these data marts:

Für solche in FlexFinance definierte Reports stehen außerdem folgende Standardfunktionen zur Verfügung:

- extensive drilldown possibilities

- possibility to compare the report for different posting days

- manual editing combined with consistency check