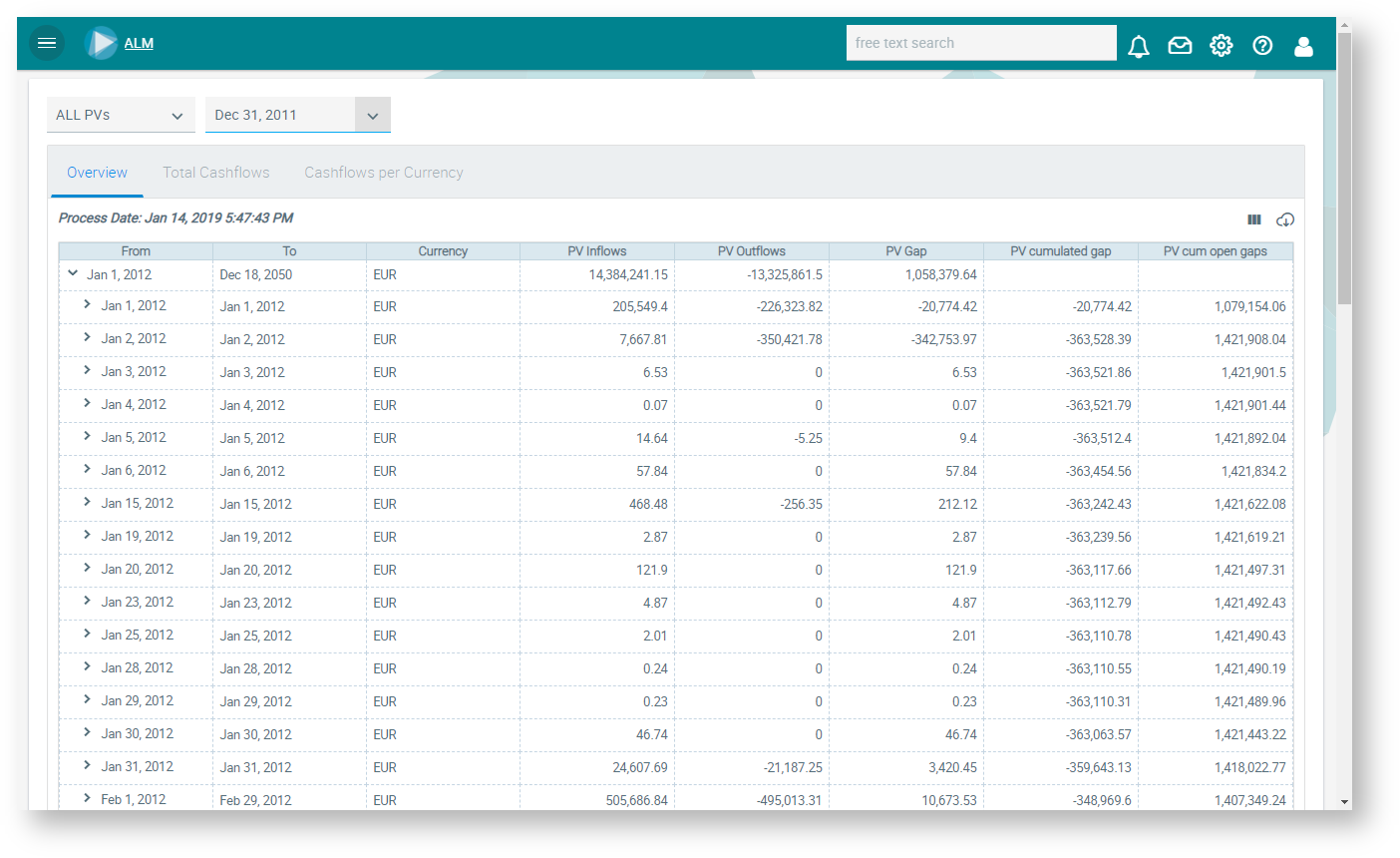

The basis for calculating present values are portfolios such as the banking or the trading book. Present values are determined using zero rates. In this case, a multi-curve evaluation, that is the use of various yield curves for each currency, is supported. The following present value ratios are available:

- Present values for the inflows

- Present values for the outflows

- Present value of the gaps (outflows minus inflows)

- Present value of the cumulative gaps

- Present value of the cumulative open gaps

The present values are displayed as totals in accordance with the freely definable periods in the period groupings. The calculation is performed in the original currency on the exact value date, which means that the values are only totalled and converted into the freely definable display currency after discounting.