Highlights: - Calculation of expected credit losses for all stages

- Consideration of macroecnonomic scenarios

- Coverage of the entire process chain of risk provisioning

- Specific workbench provides comprehensive functionaility for analysing historical default and performance data for stage 1 and stage 2

- Customer Impairment Workbench for workflows within and between work units to ensure a close follow-up of significant deals

- Embedded Performance Data Base

- Maximum auditability through traceability to individual deal level and finest granularity of calculations

|

IFRS 9 differentiates three different models of risk provisioning:

...

Beside the components for segmentation and stage assignment, the following components are important for the treatment of risk provision under IFRS 9:

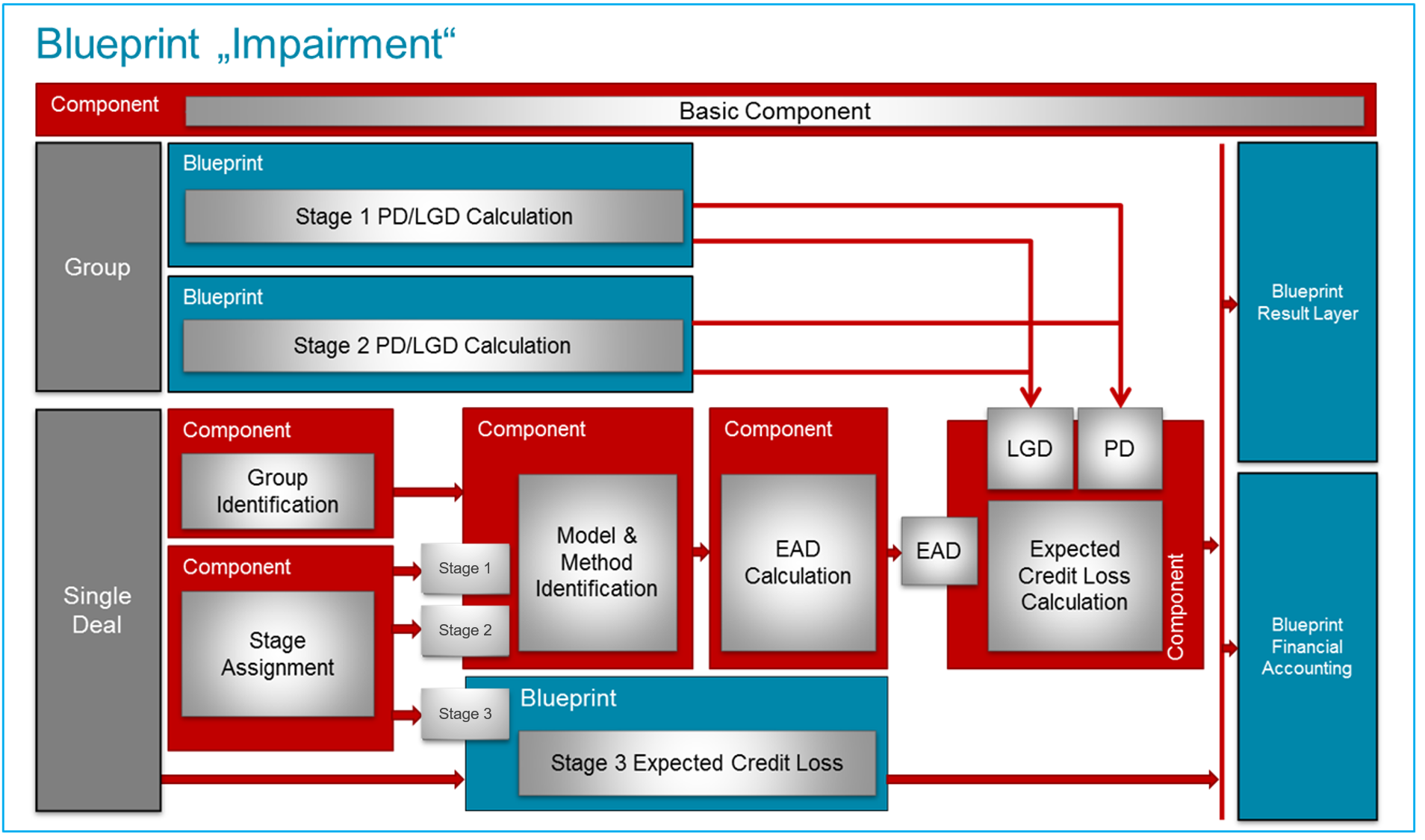

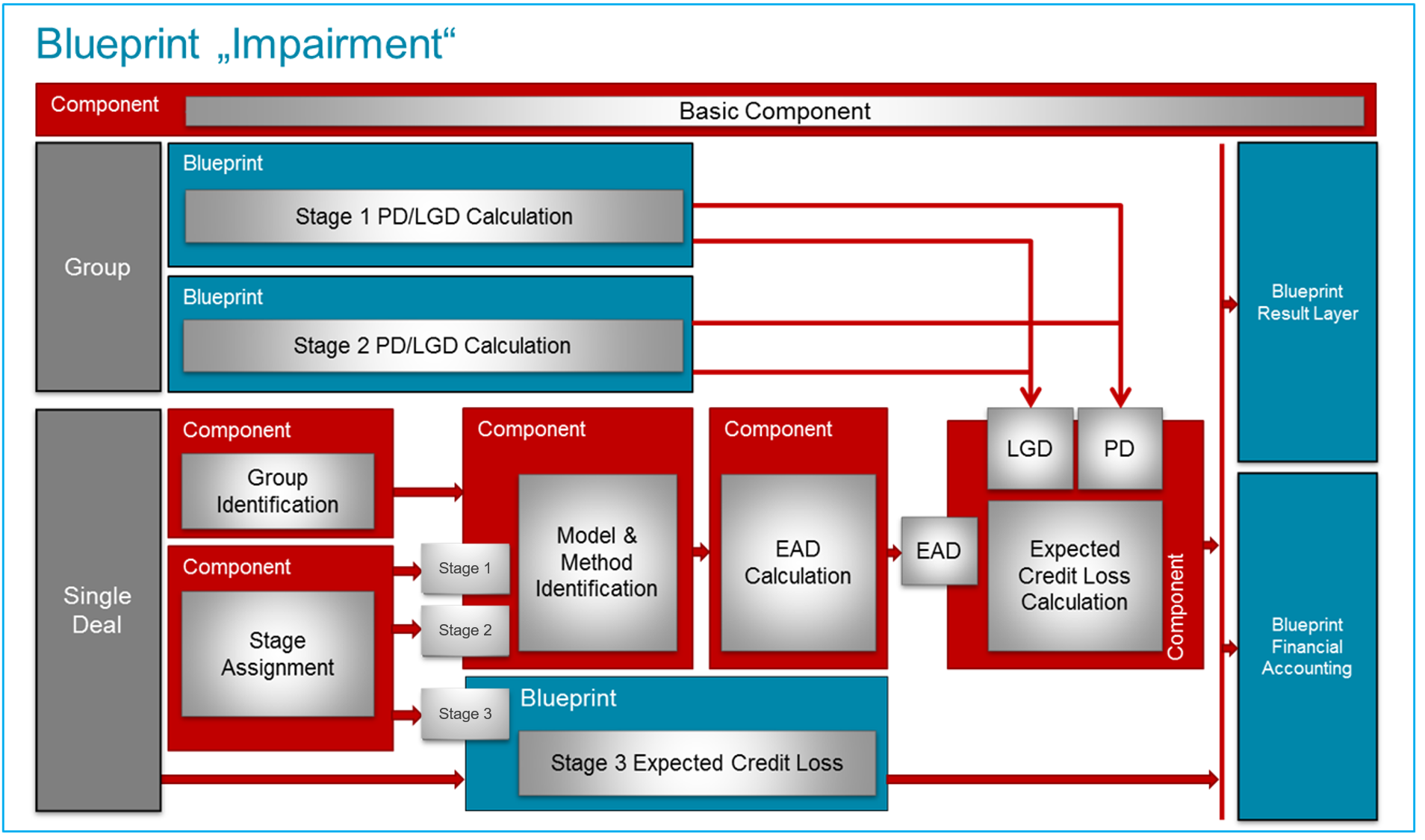

The blueprint for IFRS 9 impairment is composed of the following components and other blueprints: Image Removed

Image Removed

| Scroll imagemap macro |

|---|

| data | {"dataVersion":2,"shapes":[{"shape":"rect","coordinates":"233,192,697,164","properties":{"title":"IFRS 9 Stage 1 requires a forward-looking, 12-month expected loss estimation. This blueprint shows which modules are available for 12-Month PD and LGD calculation.","resource":{"id":"35291210","type":"page"},"target":"_blank"}},{"shape":"rect","coordinates":"228,374,705,148","properties":{"title":"IFRS 9 Stage 2 requires a lifetime expected loss (LEL) estimation. This blueprint shows which modules are available for lifetime PD and LGD calculation.","resource":{"id":"35291210","type":"page"},"target":"_blank"}},{"shape":"rect","coordinates":"628,905,564,171","properties":{"title":"IFRS 9 Stage 3 requires a lifetime expected loss assessment for loans with objective evidence of impairment.","resource":{"id":"35291227","type":"page"},"target":"_blank"}},{"shape":"rect","coordinates":"1664,194,166,423","properties":{"title":"The blueprint of the Result Layer offers components which collect and store results. There are components which support specific impirment related internal and external reporting requirements using IFRS results. The Result Layer consists of Data Marts. Data Marts can be optionally fed by all Jabatix Finance components and offer easy and transparent access.","resource":{"id":"","type":""},"target":"_blank"}},{"shape":"rect","coordinates":"1666,641,164,446","properties":{"title":"The blueprint Financial Accounting entails all components which are needed to provide balance sheet and income statement including an accounting rules engine for the generation of debit/credit-entries.","resource":{"id":"","type":""},"target":"_blank"}}],"viewSize":700,"image":{"resource":{"id":"35291201","type":"attachment-link"},"width":1908,"height":1125}} |

|---|

| alwaysHighlight | false |

|---|

|

In order to optimise operational processes, simulations can be determined several times irrespective of the current accounting process and the month-end processing. A comprehensive audit trail and audit compliance for data and methods are available for all calculations.