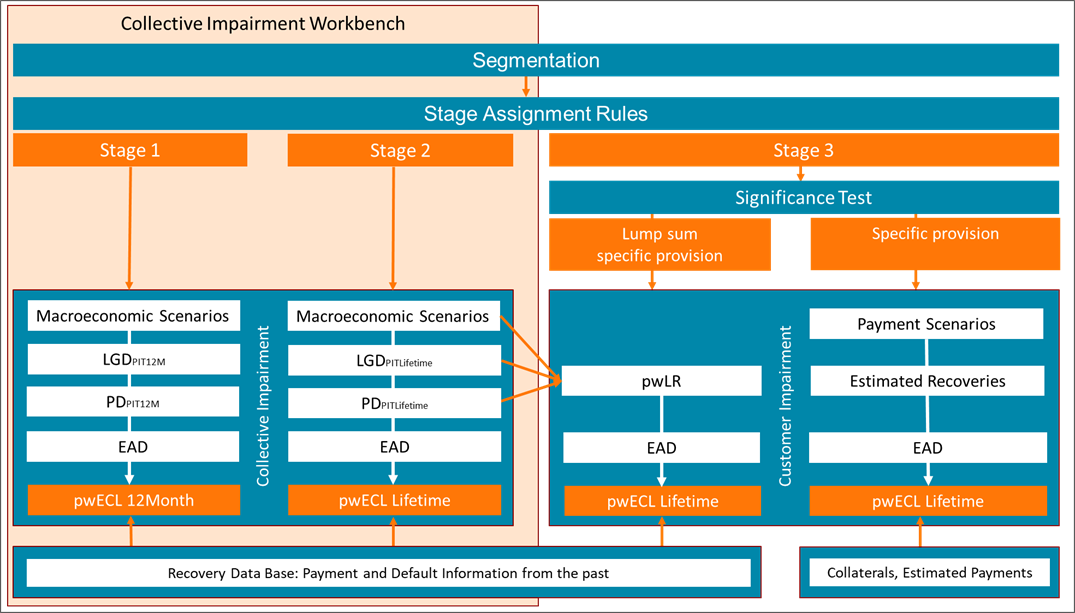

The Collective Impairment Workbench is a modular solution that calculates probability-weighted Expected Credit Losses (pwECL) in line with GAAP and regulatory requirements. For IFRS9 IFRS 9 this includes the calculation of 12-month ECLs for stage 1 as well as lifetime ECLs lifetime Expected Credit Losses for assets assigned to stage 2.

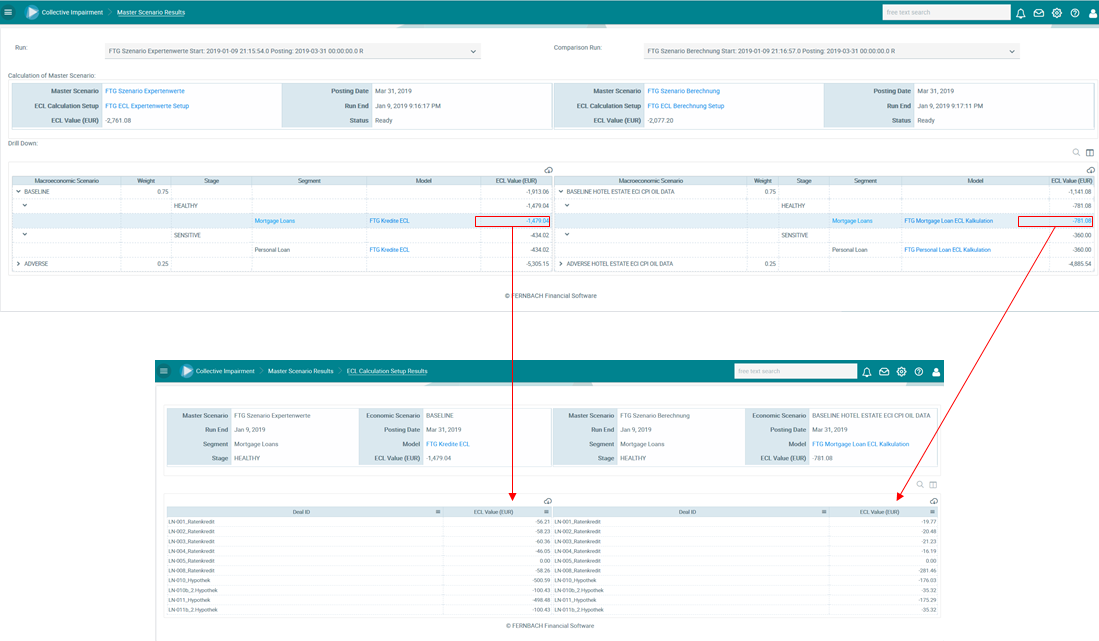

The workbench provides a browser-based UI to design master scenarios, to assign sets of macroeconomic parameters to specific models, to perform simulation runs, to calibrate PDs etc.

The Collective Impairment Workbench can It can be used as an integrated module into in an end-to-end solution for financial accounting built with Jabatix Finance Components or .

Alternatively it can be used as a stand-alone solution which soleley takes care of pwECL.

In both implementation scenarios, deals with similar credit risk characteristics must will be grouped in segments and must be assigned (depending on their deterioration of credit quality) to one of the three impairment stagesdeterioration in credit quality) to an impairment stage.

The Collective Impairment Workbench provides a browser-based UI to design master scenarios.

A master scenario contains all the rule sets which shall be applied while calculatiing probability weighted expected credit losses for stage 1 or stage 2 assigned deals.

This includes the

- Rule set for segmentation and

- Rule set for stage assignment,

- Set of values for macroeconomic parameters considered in macroeconomic scenarios,

- Settings of bundles of models which shall be applied for specific combinations of segment and stage,

- Defintion of individual models and underlying valuation elements.

Various master scenarios can be designed to check alternative settings,to perform simulation runs, to calibrate PDs etc.

A master scenario can be assigned to one or various parallel GAAP. It is possible to calculate one master scenario and consider the output in parallel GAAPs or for each GAAP a separate master scenario can be defined.

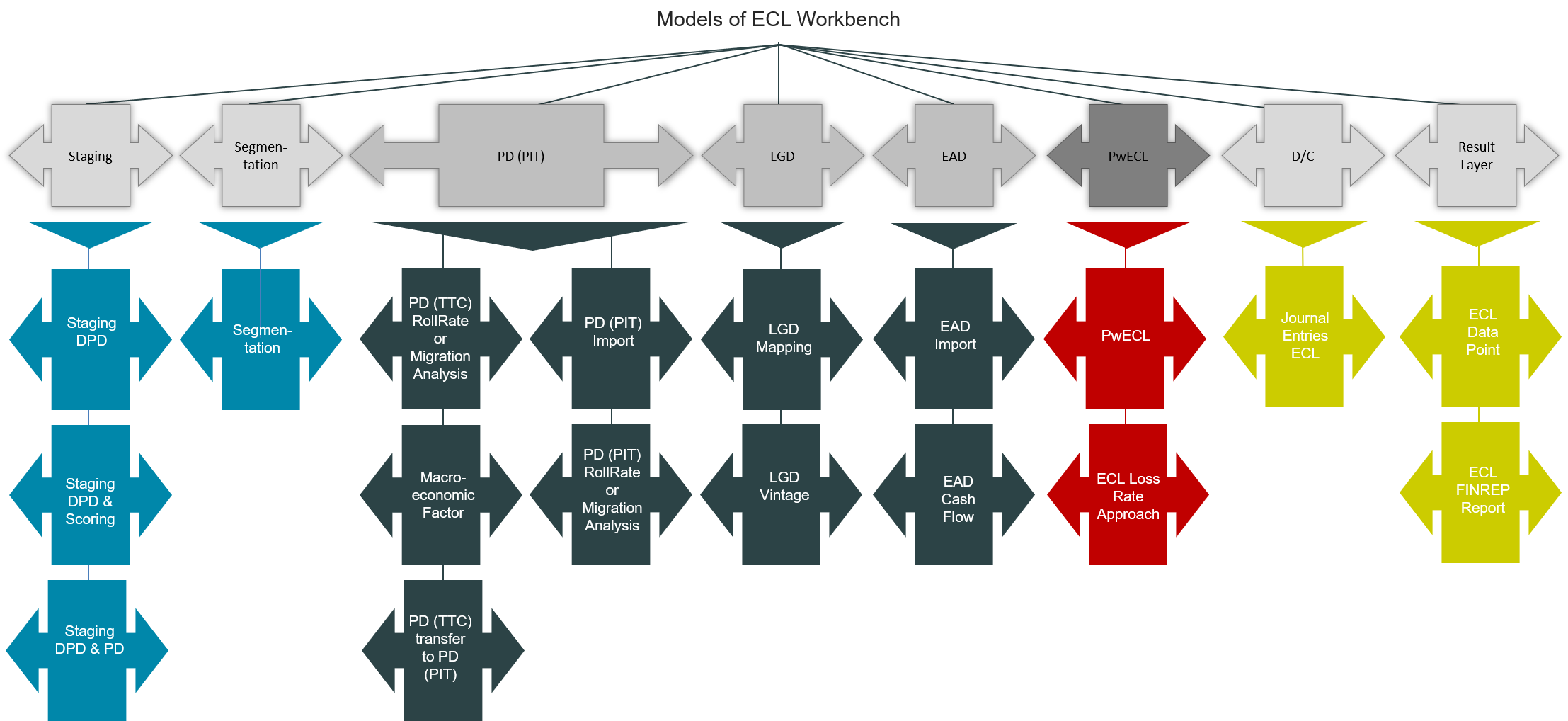

Calculation of Expected Credit Losses (ECL)

The process chain of the Collective Impairment Workbench is designed in different steps. Each step has a clearly defined input/output interface. The modular approach provides various modules for each step. Depending on the data and scope available, a financial institution can select the appropriate module for each step, comprising a large number of predefined models. Among other things, these models are geared to the needs of the business types (e.g. loans, commitments, guarantees).

...

It also supports simulation and comparison of alternative models and scenarios as well as the tracking of the results of ECL of Expected Credit Loss calculation for audit and analysing purposes.

(For details, please read more in the manual: Collective Impairment Workbench)