...

- Credit deterioration model

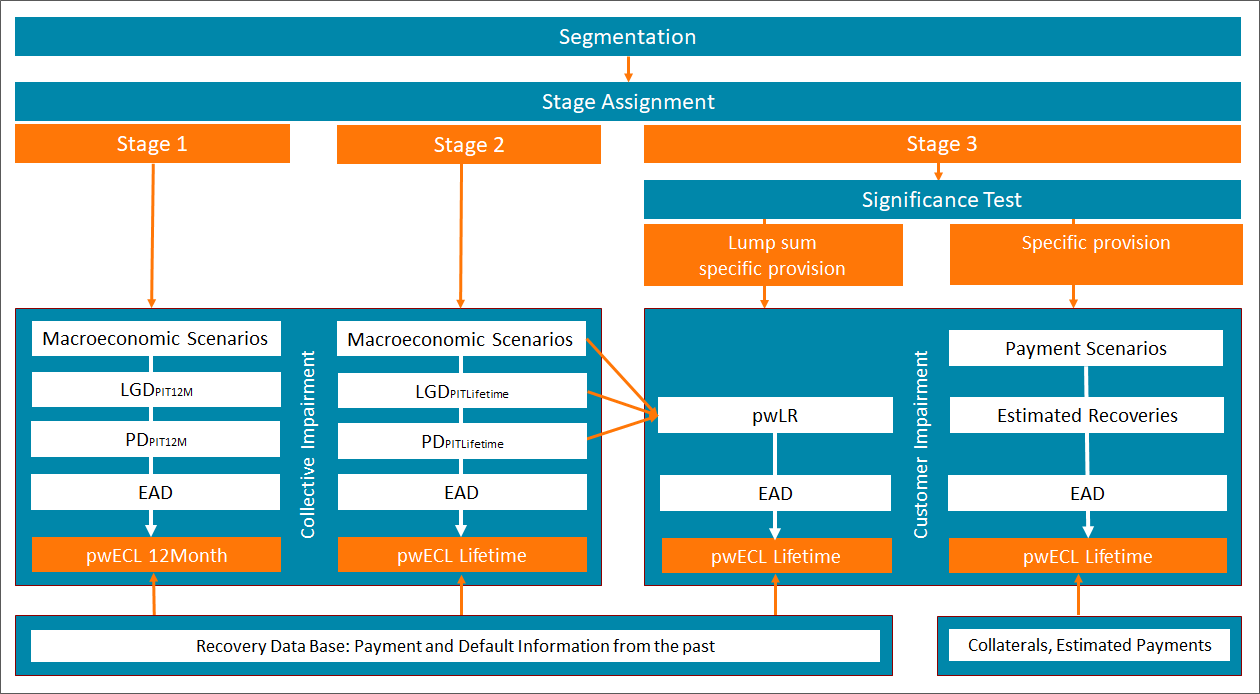

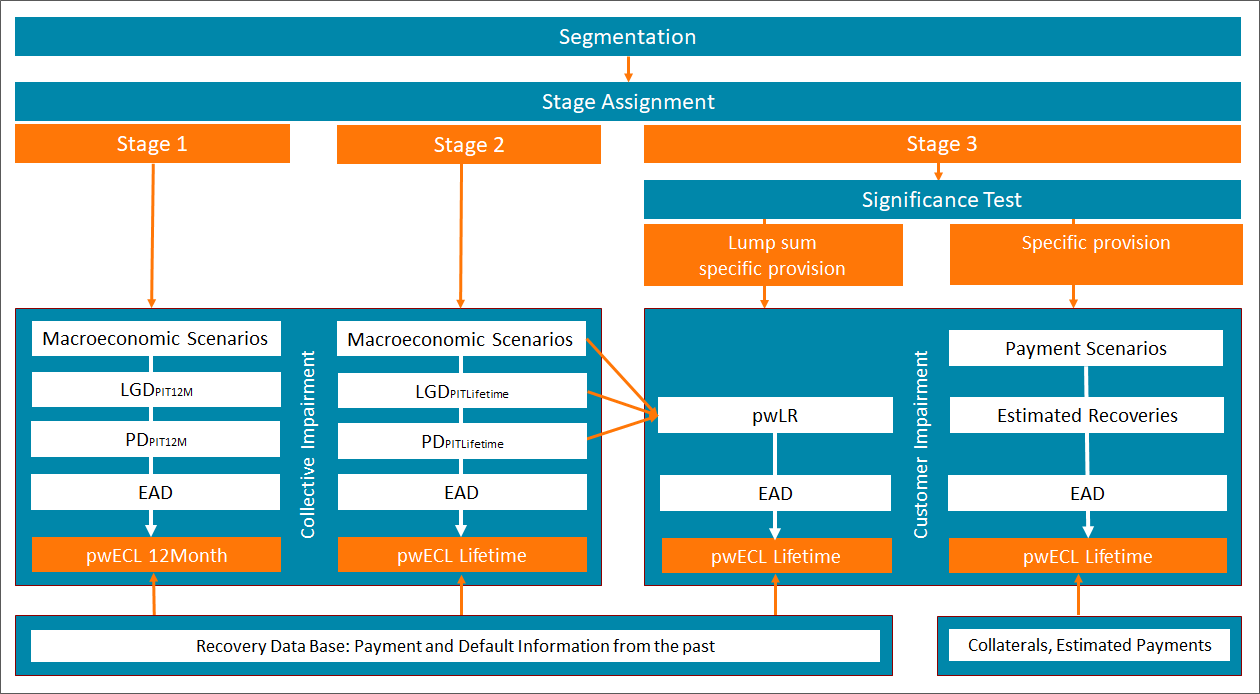

In this model, a deal will be assigned depending on its deterioration of in credit quality to one of three stages. Each stage has specific requirements regarding the calculation of the expected credit loss (ECL). All financial assets are considered in this model if they do not fullfil the conditions for the following models.

...

- Purchased or originated credit-impaired (POCI) deals

POCI deals are financial assets that are credit impaired on at initial recognition.For the treatment of POCI deals, please read more in the manual: POCI-deals.

After the introduction of IAS 39 in recent years led to a worldwide harmonisation of accounting standards, the effect was further intensified by IFRS 9. IFRS 9 has been introduced in numerous countries or is about to be introduced. In addition, numerous local accounting standards have been made accessible for IFRS values.

...

The process chain for risk provision includes the following functional steps:

- Segmentation

- Stage Assignment

- ECL Calculation

- Financial Accounting

- Reporting and Analysis

Beside  Image Added

Image Added

Besides the components for segmentation and stage assignment, the following components are important for the treatment of risk provision under IFRS 9:

...

The blueprint for IFRS 9 impairment is composed of the following components and other blueprints:

| Scroll ImageMap |

|---|

data |

|---|

| viewSize | 700.0 |

|---|

| imgWidth | 1908.0 |

|---|

| areasData | {"dataVersionareas":2,"shapes":[{"shapeshapeType":"rect","coordinatescoords":"233,197,697,166","properties":{"title":"IFRS 9 Stage 1 requires a forward-looking, 12-month expected loss estimation. This blueprint shows which modules are available for 12-Month PD and LGD calculation.","resourcepageRefIndex":{"id":"35291210"0,"typelinkTarget":"page"},"target":"_blank"}_self"},{"shapeshapeType":"rect","coordinatescoords":"238,379,689,146","properties":{"title":"IFRS 9 Stage 2 requires a lifetime expected loss (LEL) estimation. This blueprint shows which modules are available for lifetime PD and LGD calculation.","resourcepageRefIndex":{"id":"35291210"0,"type":"page"},"target"linkTarget":"_blankself"}},{"shapeshapeType":"rect","coordinatescoords":"625,900,574,179","properties":{"title":"IFRS 9 Stage 3 requires a lifetime expected loss assessment for loans with objective evidence of impairment.","resourcepageRefIndex":{"id":"35291227"1,"typelinkTarget":"page"},"target":"_blank"}_self"},{"shapeshapeType":"rect","coordinatescoords":"1661,202,166,417","properties":{"title":"The data marts collect and store results. They support specific impairment related internal and external reporting requirements using IFRS results. Data Marts can be optionally fed by all FlexFinance components and offer easy and transparent access.","resourcepageRefIndex":{"id":"35291525"2,"typelinkTarget":"page"},"target":"_blank_self"}},{"shapeshapeType":"rect","coordinatescoords":"1664,641,169,453","properties":{"title":"The blueprint Financial Accounting entails all components which are needed to provide balance sheet and income statement including an accounting rules engine for the generation of debit/credit-entries.","resourcepageRefIndex":{"id":"35291256","type":"page"},"target"3,"linkTarget":"_blankself"}}],"viewSize":700,"image":{"resource":{"id":"35291287","type":"attachment-link"},"width":1908,"height":1125}} | alwaysHighlight | false]} |

|---|

| imgRelative | Blueprint-Impairment.png |

|---|

| pageReferences | IFRS 9 Stages 1 and 2-!!!!!-IFRS 9 Stage 3-!!!!!-Core Data Mart-!!!!!-Data Marts, Analysis and Reports for Financial Accounting |

|---|

| imgHeight | 1125.0 |

|---|

| alwaysHighlight | false |

|---|

| dataModelVersion | 3 |

|---|

|

In order to optimise operational processes, simulations can be determined several times irrespective of the current accounting process and the month-end processing. A comprehensive audit trail and audit compliance for data and methods are available for all calculations.