...

- Remaining term divided into any maturity band ((e.g. < 1 year; 1-5 years, > 5 years)

- Companies or private individuals

- Sectors for corporate loans

- Type of loan (standard, acceptance credit or mortgage)

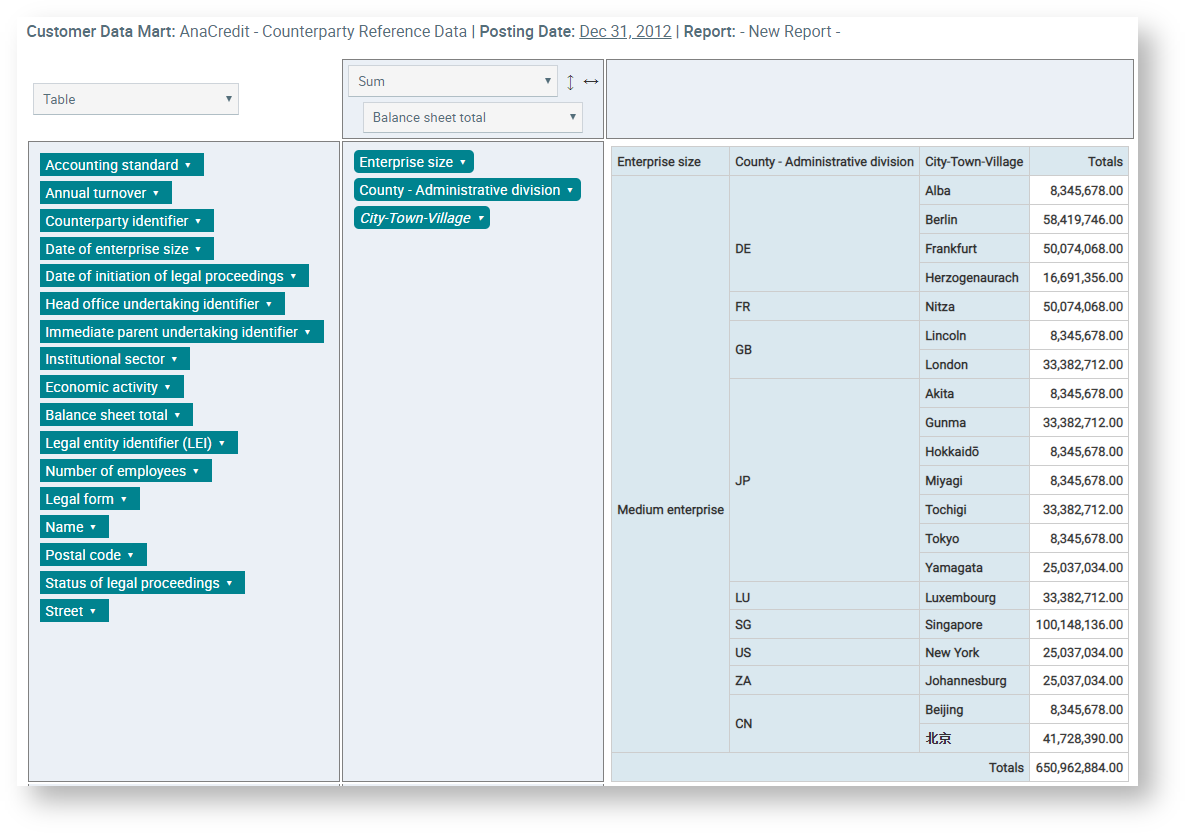

The same data marts can also be used for the reports based on AnaCredit (= Analytical Credit Datasets) which are called for by the national supervisory authorities and reported to the ECB (= European Central Bank). For this purpose, the data marts comprise more information, particularly for corporate loans. Some examples are given below:

- Information on counterparties

- Size

- Number of employees

- Counterparty’s balance sheet total

- Detailed information on individual loans

- Interest rate

- Collateral

- Outstanding payments

- Information on group structures or consortia

- Associated liabilities

- Information on deals in default

- Probability of default

- Default status

- Liquidised collateral

...

Below is an example of some customer information based on these data marts:

Für

solche in FlexFinance definierte Reports stehen außerdem folgende Standardfunktionen zur VerfügungThe following standard functions are also available for reports defined in FlexFinance:

- extensive drilldown possibilities

- possibility to compare the report for different posting daysdates

- manual editing combined with consistency check