Impaired deals are without interest. In view of IFRS, no interest-free financial instruments exist. In this sense, the "unwinding" is about the question of how changes in the present value of impaired instruments, which are only due to the adjustment of cash flows till the next posting date in view of unchanged expected recovery cash flows, have to be considered. Hence, the "unwinding" represents a substitute for the cancelled interest payments.

The recoverable amount of an impaired deal will increase at subsequent posting dates after impairment due to the changes in its time value. The difference between the original recoverable amount and the subsequent recoverable amount based on the original expected recovery cash flows will be recognised as "unwinding".

In the case of a constant gross carrying amount for a deal, the valuation element impairment adjustment will decrease on subsequent posting dates after impairment due to the recognition of the "unwinding".

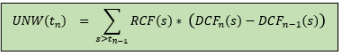

To be more precise, the unwinding UNW(tn) for a deal on posting date tn is calculated as

with expected recovery cash flows RCF(s) and discount factors DCFn(s) of the form

where EIR is the effective interest rate and Δ(tn,s) is the time gap between posting date tn and date recovery payment date s.