A forborne exposure is a deal for which forbearance measures have been taken and that has a valid “forborne” status. Forbearance measures are concessions regarding exposures, made to debtors who are facing or are about to face difficulties in meeting their financial commitments, to avoid a foreclosure. This means that an exposure can only be forborne if the debtor is facing financial difficulties which have led the bank to make concessions. The assessment of financial difficulties for a debtor should be based on the situation of the debtor only, disregarding any collateral or guarantees provided by third parties. A concession refers to

- a modification of the previous terms and conditions of the deal, or

- the refinancing of the exposure, either partially or in total.

Hence, the definition of concession is quite broad and not restricted to modifications of deals where the net present values of cash flows are affected.

Whether or not an adjustment of a contractual agreement is considered a forbearance measure can only be decided by the officer who takes the corresponding actions. For instance, the adjustment of the contractual interest rate to meet decreased market conditions can be seen as a measure to maintain positive customer relations with the entity. But, on the other hand, it can also be seen as a measure to improve the payment behaviour of a customer with financial difficulties due to a deterioration in credit quality. This differentiation has to be made in the loan management system. For information regarding the entry of forbearance measures in FlexFinance, please refer to the “Forbearance Measures” section.

A proper identification of forbearance measures requires the ability to identify signs of potential future financial difficulties at an early stage. In order to do so, an assessment of the financial situation of the borrower should not be limited to exposures with apparent signs of financial difficulties. On the contrary, an assessment of financial difficulties should also be performed for exposures where the borrower does not have any obvious financial difficulties, but where market conditions have changed significantly in a way that could possibly affect the ability to repay. For instance, this can be the case for bullet loans where the repayment relies on the sale of real estate (e. g., a drop in real estate prices) or foreign currency deals (e. g., a shift in the underlying exchange rate).

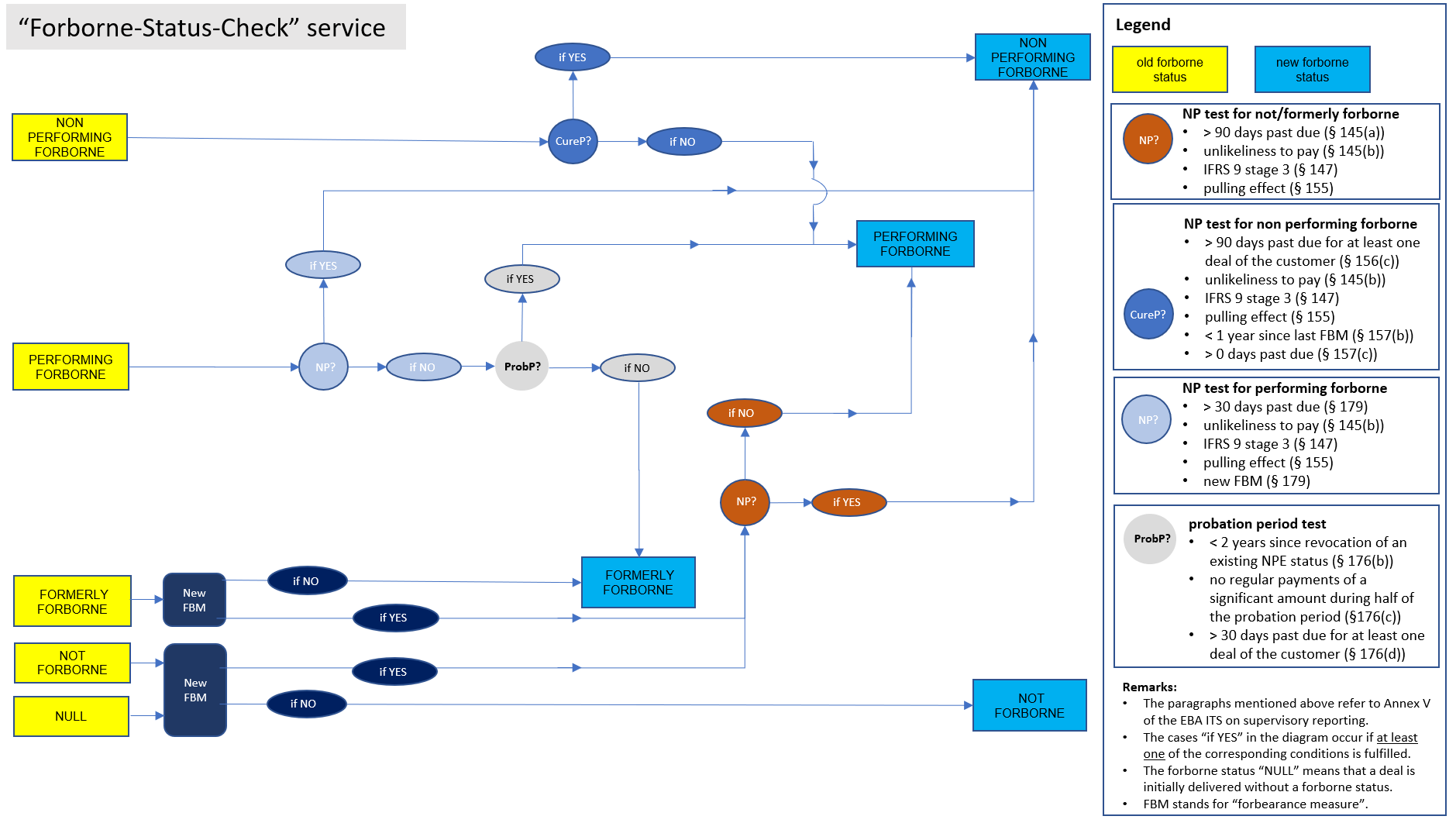

For the assignment of a “forborne” status, the following information is taken into account in accordance with the Commission Implementing Regulation (EU) No 680/2014, based on implementing technical standards submitted to the Commission by the EBA, Annex V on supervisory reporting:

- information about the “NPE” status of the deal (§145(a), §145(b), §147, §155, §156(c); for further details, please refer to the “Non-Performing Exposures” section).

- a check whether the minimum one-year cure period of non-performing forborne exposures has been successfully completed (§157(b), §157(c))

- a check whether the minimum two-year probation period of performing forborne exposures has been successfully completed (§176(b), §176(c), §176(d))

- a check whether a new forbearance measure has been taken or whether performing forborne exposures are more than 30 days past due (§179)

In FlexFinance, the above criteria are monitored on a daily basis based on the deal and customer data delivered. More specifically, the following methodology is used for assigning the “forborne” status to a deal: