Machine learning is a generic term for the "artificial" generation of knowledge from experience:

An artificial system learns from examples and can generalise these after the learning phase has ended.

So far, FlexFinance offers the use of results generated in neuronal networks for:

There is a two-step application of neuronal networks covered by FlexFinance:

- Training of the neuronal network at portfolio level

- Application of the trained neuronal network to an individual deal

Actually, machine learning provided by FlexFinance is focussed on the calculation of Probability of Default (PD), Loss Given Default (LGD) and Expected Credit Lossess (ECL). PD and LGD can be used as input into a method to derive the credit spread (CS).

The following topics are covered for each neuronal network:

- Input parameters (data considered during the training of the neuronal net)

- Setup and training of the neuronal net

- Output, e.g. early warnings over the course of time

Input parameters for the neuronal network are organised in data marts. Data is key and entails

- Customer DNA (profession, number of children, property owned etc.)

- History of deals and related payments (e.g. DPD, open payments at specific reference dates)

- Macroeconomic parameters

- Current contractual deal data (derivation of exposure at default)

For the neuronal networks,

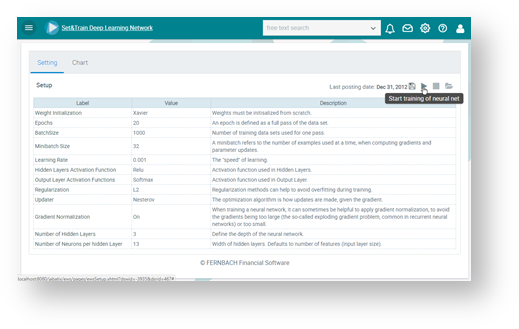

- Parameters for calculation can be defined

Figure: Parameter settings of the neuronal network

- Training of the neuronal net can be started

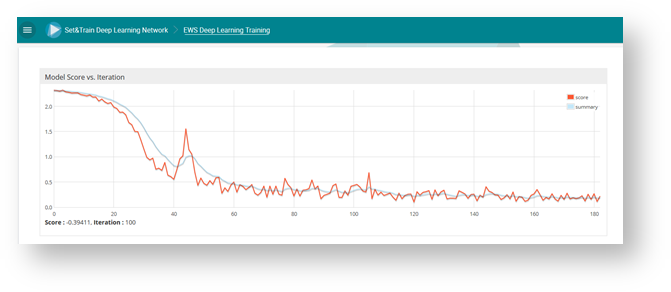

for the current posting date, using the latest run of data feed for the underlying data marts. For each training iteration, a test against the training group is performed. The test compares the prediction made on the basis of the training portfolio with the real figure in the test portfolio.

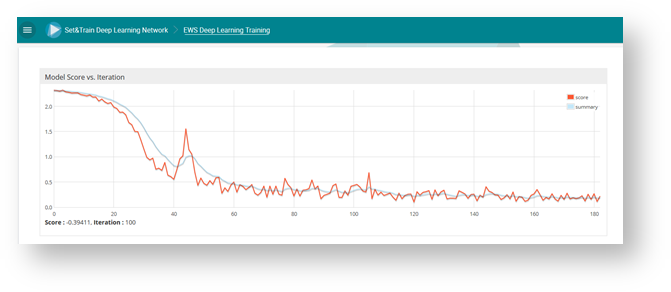

The graph below shows the training process: For the training of neuronal networks, the portfolio will be split into two groups of deals:Beside others, the number of iterations "Training ..> Testing → Training→ Testing → ..." can be configured as parameters for the neuronal network.

Figure: Model score versus iteration

- Influence of individual attributes (weight in %) can be viewed

as result of the training of the neuronal network. It can be seen which parameters and which weighting have been included in the ECL calculation for the entire portfolio of assets.

Figure: Training of the neuronal network for ECL calculation

Machine learning uses the performance database as the basis for the early warning system.