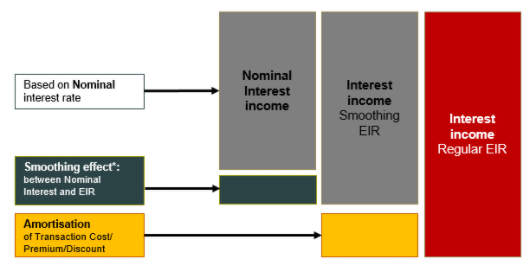

In view of the fact that entities became accustomed to posting interest on the basis of the nominal interest rate, the EIR contains more components that were treated differently in traditional accounting practice:

- Nominal interest income is still an essential part of the EIR. Similar to traditional accounting standards, it is calculated using the nominal interest rate and the day count convention defined in the contract.

- Smoothing effect:

Even for a financial instrument that only has interest and capital repayment cash flows (i.e. a financial instrument without any premiums/discounts/charges/transaction costs), its EIR is different from its nominal interest rate. The reason for this is the underlying formula: For calculating interest cash flows, a linear factor is applied and an exponential factor is used for EIR calculation. - For a loan without any premiums/discounts/charges/transaction costs, the smoothing effect represents the difference between the nominal interest rate and the effective interest rate.

- The total sum of the smoothing effect is 0, meaning that the total sum of the effective interest equals the nominal interest for a plain financial instrument without anything to be amortised.

- The amortisation of premiums/discounts/charges/transaction costs represents the difference between the initial amount and the maturity amount.

For a financial instrument with premiums/discounts/charges/transaction costs, the sum of the three components “nominal interest income”, “smoothing effect” and "amortisation" represents the theoretical effective interest as defined in IFRS 9.

While interest income has to be posted on the basis of the effective interest method, it is still up to an individual entity (with approval from the auditor and the regulator) to interpret the standard. More specifically, an entity has a certain flexibility with regard to deciding how to post the different components as part of the effective interest. During the implementation of the standard, various practices/interpretations have emerged:

Practice 1: Interest income is posted directly on the basis of the EIR. It means that all components of the effective interest are posted to the P&L "in one piece".

Practice 2: Post amortisation in interest results on top of the nominal interest. As such, the amortisation of premiums, discounts, charges and transaction costs is based on the effective interest method, whereas the recognition of the nominal interest and the amortisation in the interest result ensures consideration of the effective interest income, as required by IFRS9.

While either practice has been accepted by auditors and regulators, and the impact of the difference between these two practices on financial statements can be immaterial, using different practices can have a significant impact on technical performance.

Nevertheless, keeping all valuation components separate

- simplifies financial accounting:

- IT enables FlexFinance to post amortisation only if premiums/discounts/charges/transaction costs etc. exist.

- Reduces the number of deals to be processed, only considering those with IFRS challenges.

- Far fewer entries will be generated if the deal has no transaction costs.

- improves transparency of the income statement while financial accounting ensures maximum transparency regarding the differentiation between:

- real payments

- accrual

- amortisation

- reflects the economic truth of the financial instrument:

- Amortisation will be posted to different accounts to be separated from nominal interest income.

- For off-market loans, a synthetic premium/discount will be amortised. Moreover, only this approach ensures that, in financial accounting, the effectively paid contractual interest can be separated from the theoretical EIR payments.