Incoming payments are assigned to the loan as well as the individual receivables in the account management system.

In this case, the general, national, legal and regulatory requirements are taken into account.

The detailed regulations in this regard are country-specific but bank-specific regulations can be added.

In Germany for example, the legal requirements from section §367 of the German Civil Code for the ‘Debiting of interest and costs’ are applied, in which case the incoming payment is added to the costs, then to the interest and finally to the main payment, if the actual amount of the claim has not been paid in full.

In this case, the actual amount of the claim is the amount that has still to be paid as of the current due date. It is not the entire amount of the claim for the deal.

Problems should be dealt with after the incoming payments have been distributed automatically. These include underpayments, overpayments and non-assignable payments.

Example:

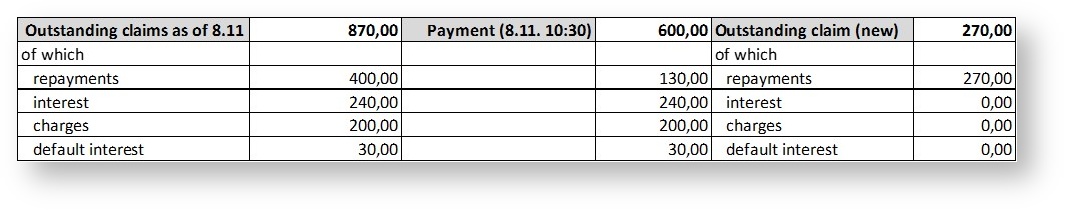

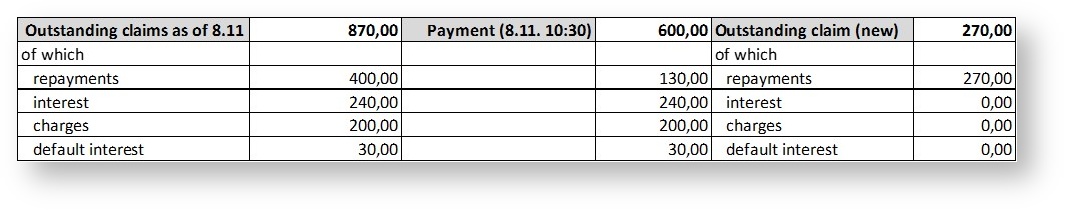

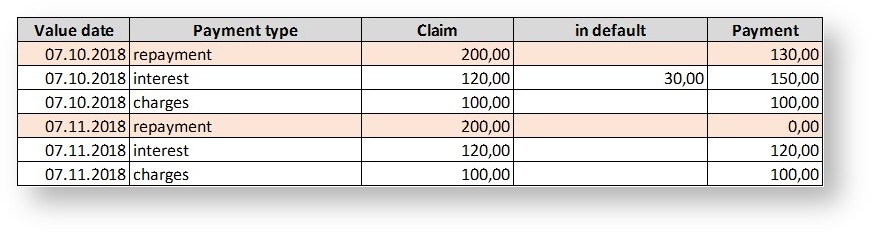

There is an outstanding claim as of 8th November for the amount of 870,00 euros that is made up of payments due for the set dates of 7th October and 7th November 2018.

A payment of 600 euros is made on 8th November. This payment does not cover the claim in full and is therefore subject to the distribution rule. Firstly, the claims from the charges (7.10.: 100,00, 7.11. 100,00), then the claims from the interest (7.10.: 150,00, 7.11. 120,00) and then the main claim (7.10.: 130,00) are paid from the 600 euros. In this case, the main claim can only be serviced in part.

Overpayments/special payments

If the payment received exceeds the amount of the claim up to a fixed date, the excess amount can be processed as a special payment at the deal.

This special repayment shortens the term for the loan. The payment plan is then adjusted. The regular payment instalments remain unaffected.

In exceptional cases where an overpayment results in an overpayment of the entire loan, the loan is recorded as paid and cleared and the residual amount can be posted as a credit note on the payer’s account for the payment received.