Since this Expected Credit Loss component is used for loans, money market assets and bonds, it is the most common and important one.

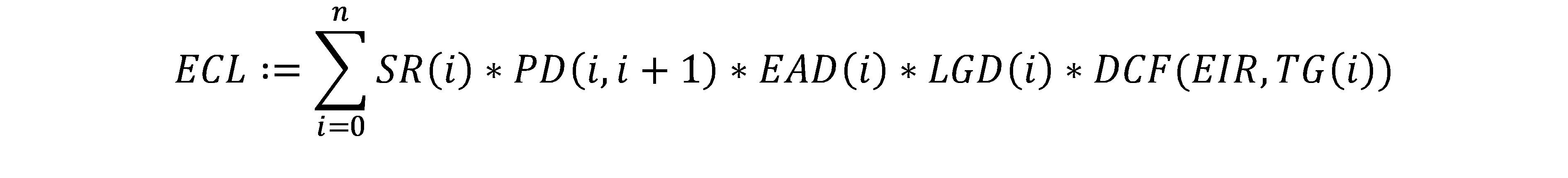

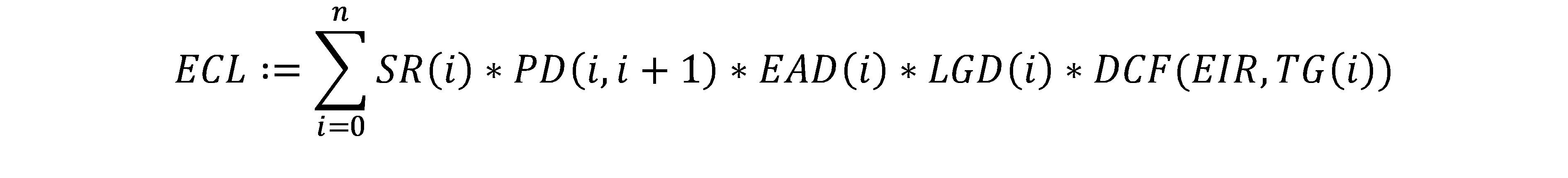

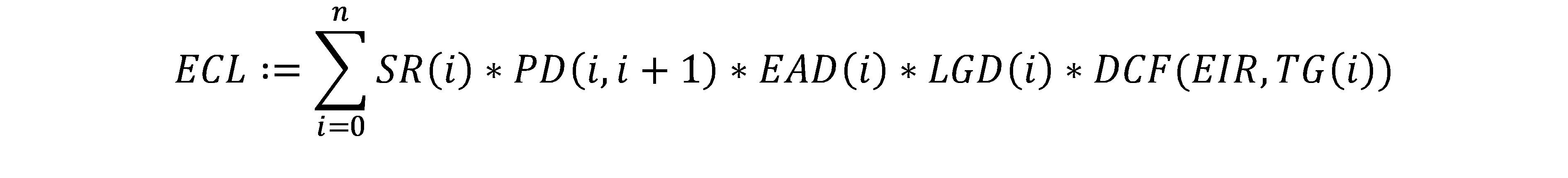

In the probability-weighted approach, the solution calculates the expected credit loss for an individual deal by applying the following Expected Credit Loss component:

Here,

- i goes through the periods 0,...,n until the maturity of the deal. A period can be a month up to a year.

- SR ( i ) is the survival rate of the deal for period i, i.e. the probability that the deal will not default until period i.

- PD (i, i + 1) is the probability that, under the assumption that the deal has not yet defaulted at the beginning of period i, the deal will default during period i.

- EAD ( i ) is the deal’s exposure at default that is expected for period i.

- LGD ( i ) is the loss given default. It is expressed as a percentage of the exposure that is likely to be lost when the deal is in default.

- DCF (EIR, TG ( i )) := e -EIR*TG ( i ) is the discount factor that adjusts the expected loss to its time value as of the reporting date, where EIR is the effective interest rate and TG ( i ) is the time gap between the beginning of the deal and the current period i.

This Expected Credit Loss is the lifetime value of the deal, covering its whole remaining term. For deals in stage 1, where the credit risk did not increase significantly since initial recognition, n is adjusted accordingly so that it covers 12 months.