Depending on the forbearance measure to be granted, a different significance test is carried out. Measures are categorised as follows:

In both cases, a predefined percentual significance threshold is used, and a check is carried out to determine whether the business events related to a forbearance measure lead to changes in the payment plan which exceed the predefined significance threshold.

According to §51 of the EBA’s Final Report on the Guidelines on the application of the definition of default under Article 178 of Regulation (EU) No 575/2013 (EBA/GL/2016/07), institutions should set a threshold for the diminished financial obligation that the institution considers to be caused by a significant waiver of claims or a deferral of principal, interest or fees. This threshold should not exceed 1%.

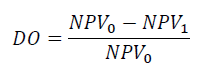

For each forbearance measure which does not include a sale of the asset, a checked is carried out to determine whether the corresponding changes in the payment plan exceed this threshold. This is done using the following formula:

where

DO is the reduced financial obligation

NPV0 is the net present value of cash flows (including unpaid interest and fees) expected under the original contractual obligations

NPV1 is net present value of the cash flows expected based on the business events of the forbearance measure

Both present values are calculated using the deal’s original effective interest rate (EIR). If DO exceeds the predefined threshold, the forbearance measure is to be considered as significant.

According to §44 of the EBA’s Final Report on the Guidelines on the application of the definition of default under Article 178 of Regulation (EU) No 575/2013 (EBA/GL/2016/07), institutions should set a threshold for the credit-related economic loss related to the sale of credit obligations to be considered material. This threshold should not exceed 5%.

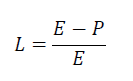

For each forbearance measure which includes a sale of the asset, a check is carried out to determine whether the extent of the economic loss exceeds this threshold. This is done using the following formula:

where

L is the economic loss related to the sale of credit obligations

E is the total outstanding amount of the obligations subject to the sale, including interest and fees

P is the price agreed for the sold obligations

If L exceeds the predefined threshold, the forbearance measure is to be considered as significant.