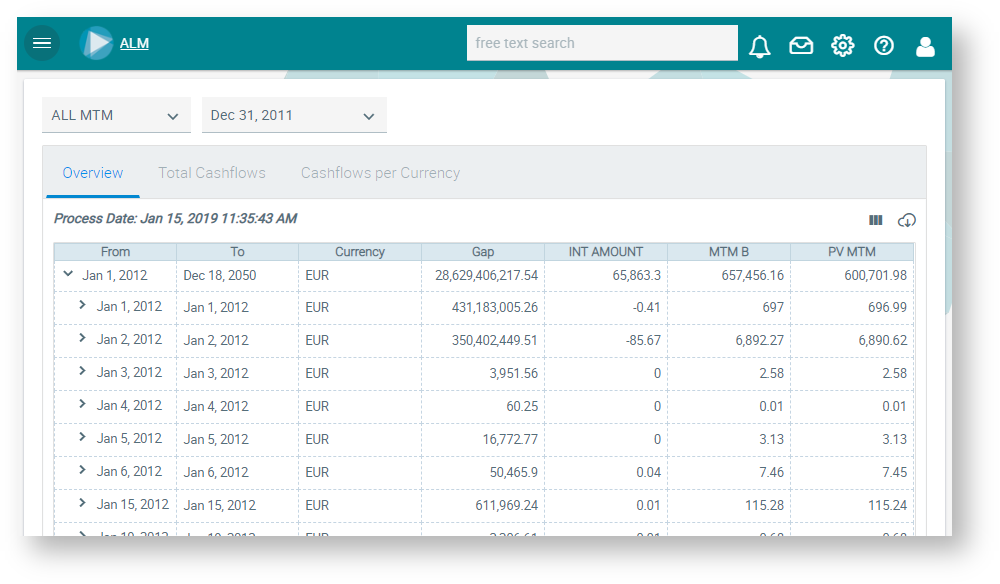

Mark-to-market valuation is the determination of the interest (at present value) for a selected portfolio if the relevant position is closed at money market or capital market interest rates. In this case, the interest is calculated using the difference between capital payments and the current market interest rates and then compared to the open interest positions (outflows minus inflows for interest payments). The difference is the mark-to-market amount.

This calculation is also provided as a present value based on current market data. A calculation using interest rate scenarios is also possible.