The duration is used to determine the future date when the interest rate risk for a portfolio is completely eliminated. From this point onwards, the actual value of the portfolio, irrespective of any changes in the interest rate, is always greater than or equal to the value predicted at the present time. The following calculation methods are available for calculating duration:

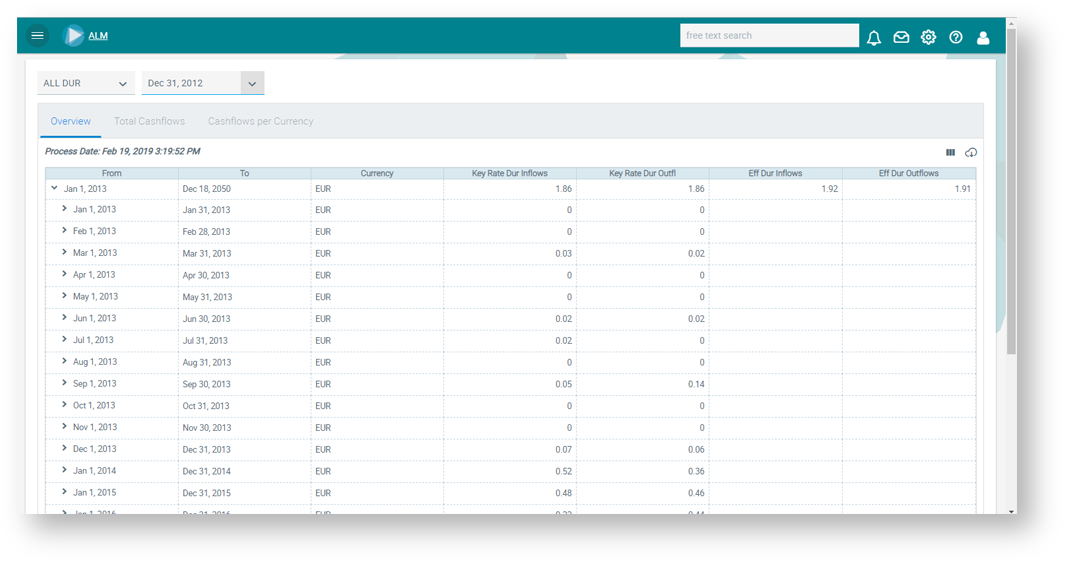

Effective Duration

The effective duration is a portfolio ratio, meaning that it is only calculated and displayed over all time periods. The current market interest rates are taken from the relevant yield curve and used for the effective duration.

Key Rate Duration

The key rate duration is the sensitivity of the effective duration to changes in the maturity-adjusted interest rate (key rate). As the formula for the calculation of the key rate duration is additive, the total sensitivity is obtained by adding together the individual sums per maturity. Of particular note here is that the effective term structure of interest rates can be used as a basis for valuation and that the effective interest curve is not flat.

The solution supports the calculation of both duration ratios using interest rate scenarios.