FlexFinance provides data marts that contain all the accounting information needed to compile the following reports. This allows all the requirements for FinRep reports (= FINancial REPorting) as defined by the EBA (= European Banking Authority) to be fulfilled.

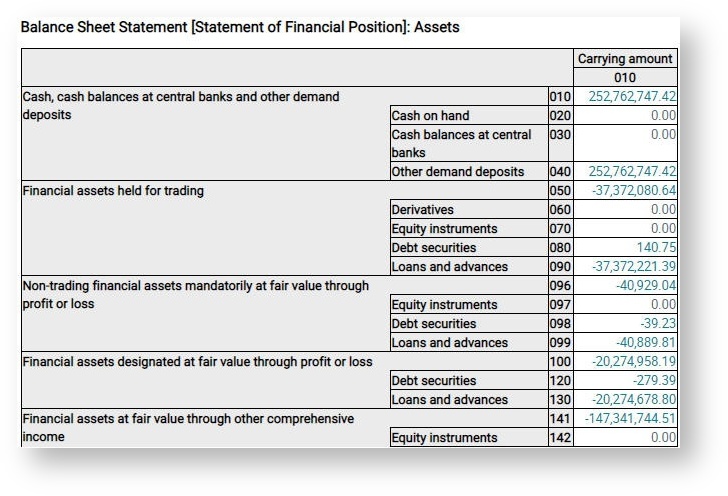

- Balance sheet

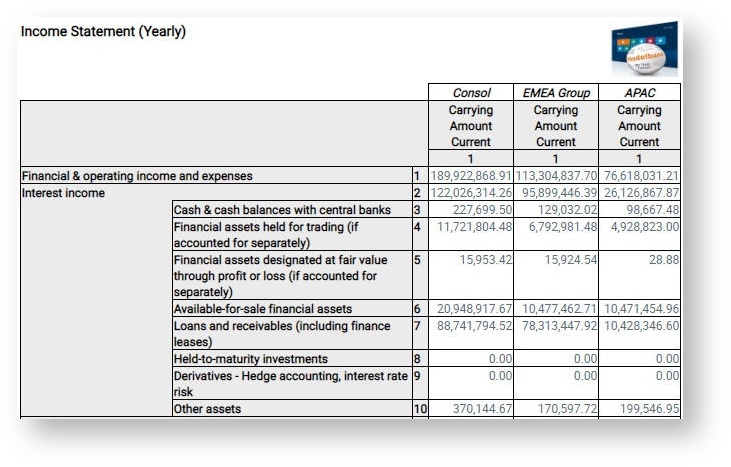

- Profit and loss account

- Breakdown of financial assets and liabilities according to various criteria

- Breakdown of positions on the profit and loss account

- Impairment, collateral, commitments, guarantees and other obligations

- Geographical breakdown

- Group structure

- Breakdown of and changes in equity (cash flow statement)

- Associated persons

- Trading activities

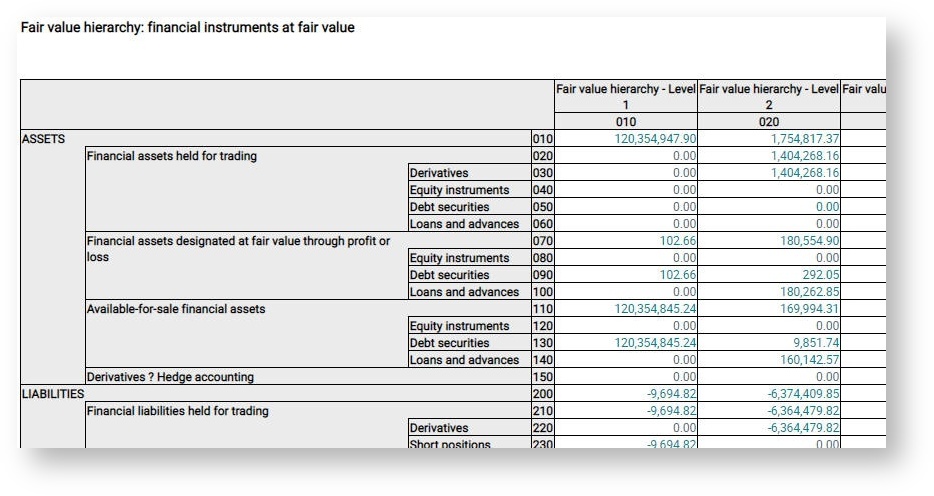

- Fair value hierarchy

- Hedge accounting

- Book value using valuation methods

All the information required to differentiate between financial products and counterparties as well as all the individual components or valuation elements needed for the financial reports is contained in the data marts.

- Amortisation

- Fair value

- Accrual/deferral

- FX results

- Individual components in book values

- Long-term receivables

- Accrued/deferred interest/charge receivables/expenses

- Premiums/discounts

- FV change market/credit spread

- Individual components in the P&L account

- Interest/charges income/expense

- Trading/investment results

- FX results

- Impairment/write-off expense/unwinding

The data marts provided for the accounting information are explained in detail in the section Data Marts, Analysis and Reports for Financial Accounting.

Below are some examples of financial reports in FlexFinance based on these data marts:

Special feature: If there are several business units to be consolidated in FlexFinance, consolidated views of financial reports are available, including individual statements for each business unit.

The following standard functions are also available for reports defined in FlexFinance:

- extensive drilldown possibilities

- possibility to compare the report for different posting dates

- proof of rule for reporting contents

- manual editing combined with consistency check