...

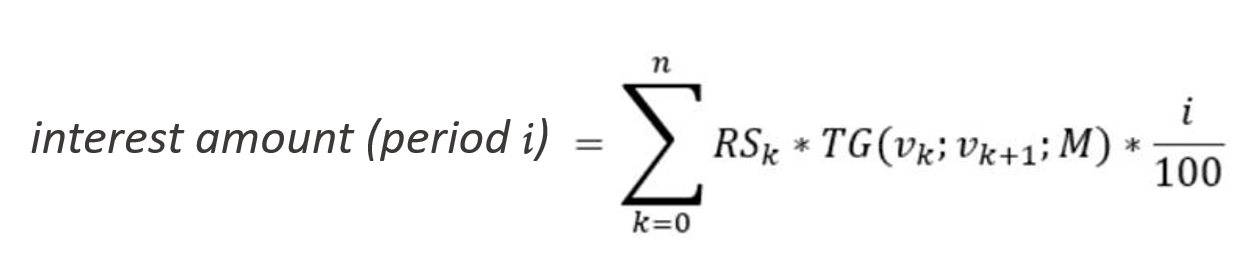

If one or more repayments or capital increases are due within the accrual period of an interest period, the relevant period of the interest period is divided according to the respective changing interest-bearing residual debt for the calculation of the accrued interest. In the calculation, the period to be accrued is divided into appropriate sub-periods according to the number of repayments. The remaining debt in these sub-periods is different.

where

n: Number of capital changes (repayments, increases or capital interest) in the accrual period of an interest period.

RSk: Remaining debt after the k-th capital change in the accrual period of the interest period.

If interest is capitalised, the remaining debt is changed. In this case, it should be noted for the above procedure that the remaining debt must be adjusted accordingly. With regard to annuities, the amount paid contains the interest as well as the repayment due. In this case, the repayment portion results from the annuity amount delivered and the interest portion to be paid. Therefore, this affects the repayment portion and thus the remaining debt still valid for further interest calculations.

TG(vk,vk+1,M): Time gap from the period vk: to vk+1 for the day count convention M

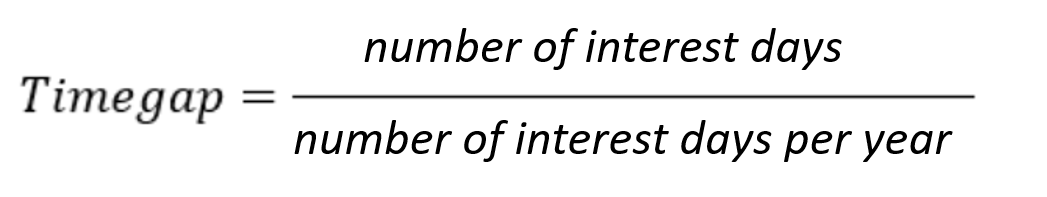

The time gap is defined as the quotient:

The number of interest days and interest days per year depends on

...