The European Banking Authority (EBA) has set out a guideline , illustrating when a risk position is to be disclosed as a ‘Non-Performing Engagement’ “non-performing exposure” (NPE) in the EBA reporting system.

As parameters for rating ‘NPE’, certain criteria have been taken into account, such as:

- Number of days past due

- Significance of the measure

- Bank’s expectation regarding the recovery of the debt after implementation of the measure

- Relevance of the risk position

- Product type

The product type is, among other things, relevant for the analysis of whether the risk position can be attributed to retail business and consequently whether there is an option to assess only a specific risk position as an ‘NPE’. Otherwise the following applies: If several risk positions are assigned to a borrower, the status ‘NPE’ is to be assigned to all risk positions if this status has been determined for at least one risk position. However, this is also the case, irrespective of retail business, if the reason for the forbearance measure suggests that default on all risk positions is to be expected.

A forbearance measure is meaningful if the borrower's reduced financial obligation resulting from restructuring is higher than a defined threshold. For this purpose, the degree of change in the liability should be calculated according to the measure and checked against a configured threshold.

For risk positions that are already classified as 'NPE', it must be checked periodically to determine if a 'recovery' has taken place and whether the status can be set to 'not defaulted'. The procedure for this check depends on whether the classification 'NPE' was originally allocated in the context of a forbearance measureThe uniform definition of NPE was issued in order to overcome problems deriving from the existence of different definitions in this context. However, the NPE definition is currently only binding for supervisory reporting purposes. Nevertheless, banks are encouraged to use the NPE definition in their internal risk control and public financial reporting as well.

One of the aims of the new NPE definition is to make data more comparable by overcoming the differences in the “defaulted” and “impaired” definitions across the European Union. In this regard, the NPE definition should act as a harmonised asset quality concept.

NPE is a concept potentially broader than the concept of “impaired” in IFRS 9 and “defaulted” in the Basel guidelines. All impaired exposures and all defaulted exposures are necessarily NPEs, but NPEs can also comprise exposures that are not recognised as impaired or as defaulted in the applicable accounting or regulatory framework. For instance, exposures of debtors who are assessed as unlikely to pay their credit obligations are always considered as NPEs regardless of the existence of any past-due amount or of the number of days past due.

According to the Commission Implementing Regulation (EU) No 680/2014, based on implementing technical standards submitted to the Commission by the EBA, Annex V on supervisory reporting, a deal is classified as an NPE if at least one of the following conditions is fulfilled:

- material exposures which are more than 90 days past due (§145(a))

- the debtor is assessed as unlikely to pay their credit obligations without realisation of collateral (§145(b))

- the deal is in IFRS9 impairment stage 3(§147)

- the deal is under the “pulling effect” of an NPE of the same customer, i. e. there is one deal of the same customer which is more than 90 days past due and which covers a volume of at least 20% of the customer’s overall exposure (§155)

Regarding the cure/exit of the NPE status, the following aspects have to be considered:

- In case of deals which are not forborne exposures, a former NPE turns into a performing deal if none of the above conditions is fulfilled anymore and if there is no other deal of the same customer which is more than 90 days past due (§156(c)).

- In case of forborne exposures, special further conditions for leaving the NPE status apply:

- for instance, a cure period of at least one year must have passed before a non-performing forborne exposure can turn into a performing forborne exposure.

- for more details regarding the relation between forborne and non-performing exposures please see the “Forborne Exposures” section.

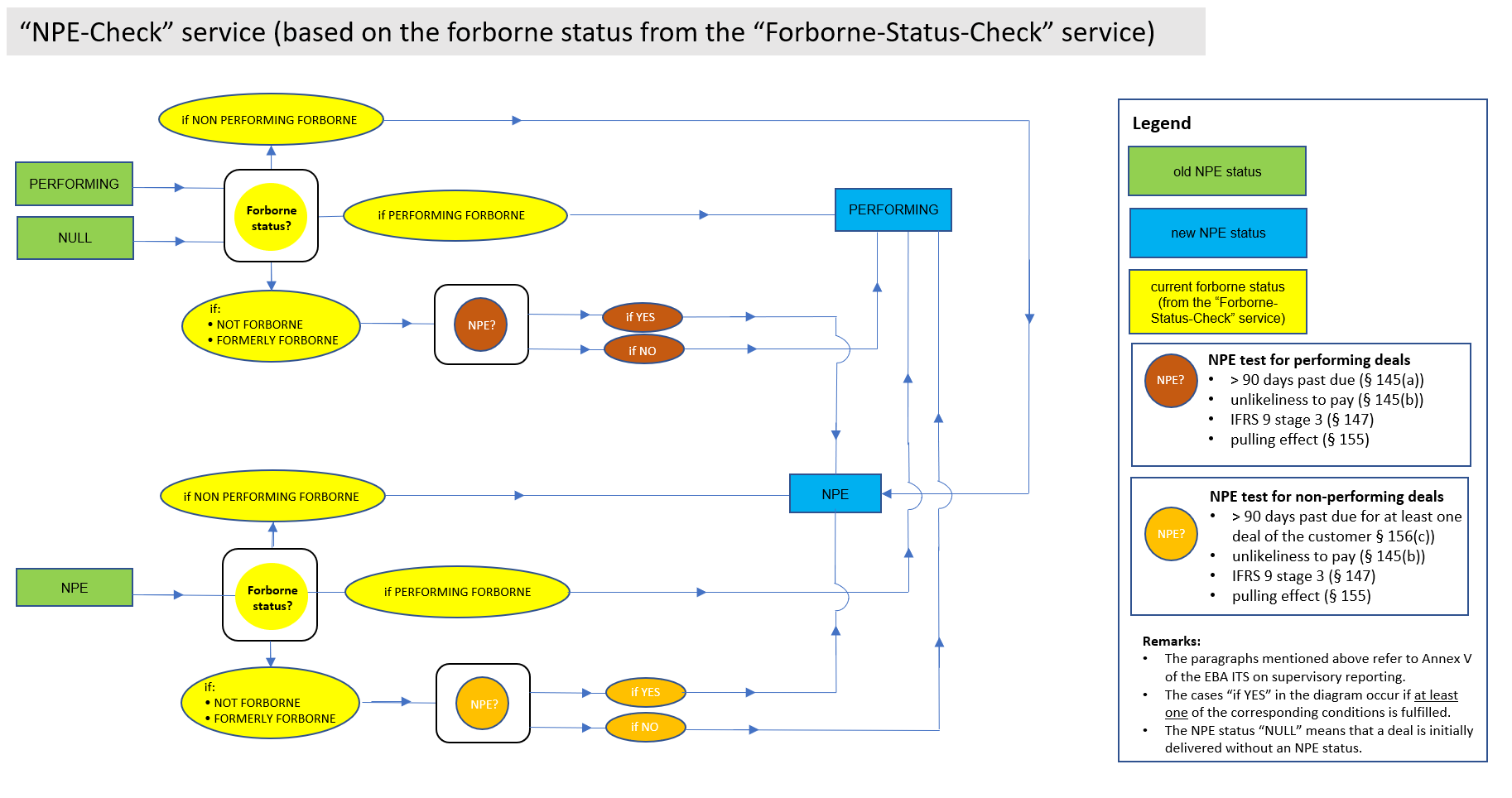

In FlexFinance, the above criteria are monitored on a daily basis based on the deal and customer data delivered. More specifically, the following methodology is used for assigning the “NPE” status to a deal:

As already mentioned before, the derived NPE status depends on the forborne status for all deals for which forbearance measures have been performed and the forborne status is still valid.