...

- Collateral during Expected Credit Loss calculation

FlexFinance considers the collateral values allocated during- Expected Credit Loss calculation using statistical methods in stage 1 and 2 as well as non-significant deals assigned to stage 3

- Expected Credit Loss calculation using individual recovery cash flows for stage 3 significant deals

- For details of the calculation for stages 1 and 2, please refer to Impairment IFRS 9 Stages 1 and 2.

- For stage 3, non-significant deals in a lump-sum specific approach, an Expected Credit Loss model needs to be defined in the Collective Impairment Workbench that calculates the Expected Credit Loss on the basis of an adjusted EAD

- For stage 3 significant deals in a specific provision approach, collateral is a source for recovery cash flows besides other recovery types. These recovery cash flows are discounted and compared with the total exposure.

- For details of the calculation for stage 3, please refer to Impairment IFRS 9 Stage 3.

The different scenarios lead to a probability-weighted Expected Credit Loss for stage 3 impaired significant deals.

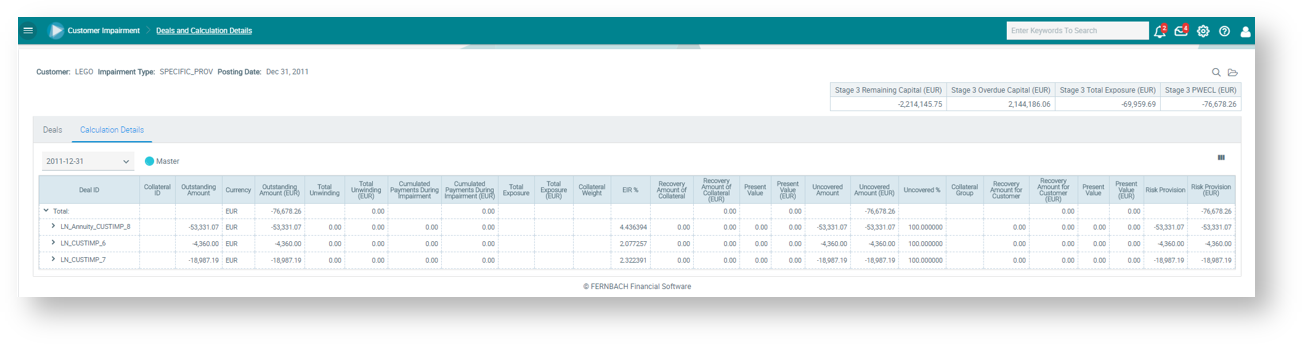

Figure: ECL Expected Credit Loss calculation results at individual deal level for specific provisioning