...

Diagram: Valuation elements supported by Jabatix Finance FlexFinance Hedge.

Since the financial crisis, due to market evolvements, tenor basis spread and currency basis spread have significant impact on valuation of financial instruments. At the same time the multi-curve valuation approach has been commonly adopted. In multi-curve valuation for collateralised transactions, the OIS curve is applied as the discount factor while cash flow forecasting is based on the forward rate curve related to specific tenor (3M, 6M etc).

In case of uncollateralised transactions, the followings options are provided:

The OIS curve can be still used as a discount factor to calculate the so-called “no default” fair value. The fair value of the financial instruments will be then adjusted by CVA and DVA. As practice in some banks, regular LIBOR/EURIBOR can also be used as discount factor. Or,

The credit spread is applied on top of benchmark curve like the OIS or the LIBOR curve as part of the discount factor. This can be used in case the fair value of the financial instrument is always positive (as asset) or always negative (as liability)

FlexFinance measures the effectiveness of a hedge relationship according to a pre-defined measurement schedule, which is configured according to your risk management strategy. At the most rudimentary level, the measurement takes place at the initial valuation of the deal and when the bank prepares its financial statements. The measurement takes place automatically.

The following prospective and retrospective effectiveness tests are supported:

...

- Hedge Financial Accounting

- Rule-based generation of debit/credit entries

- Rule-based generation of debit/credit entries

- Hedge Reporting

Different hedge types are permitted under hedge accounting. Flex Finance supports the creation of

- Cash Flow Hedges

A future cash flow that is safeguarded against certain risks that might affect profit or loss is defined as a cash flow hedge.

A typical example of a cash flow hedge is the safeguarding of interest payments for a variable-rate bond by a receiver interest rate swap which entails transforming the future variable interest payments into payments with a fixed amount.

The accounting practice in the Jabatix Finance Hedge Manager for hedged items and hedging instruments in a cash flow hedge fulfils the requirements for Hedge Accounting under IFRS. The hedged item is still valued and accounted for in accordance with the regulations in force while the hedging instrument is designated at full fair value and is disclosed at this value on the balance sheet.

- Fair Value Hedges

A fair value hedge entails safeguarding against fair value changes in hedged items and hedging instruments. The following are to be recognised in profit or loss:

- the profit and loss from changes in the fair value of the hedging instrument and

- the profit and loss from changes in the fair value of the hedged item, in so far as these are related to the hedged risk.

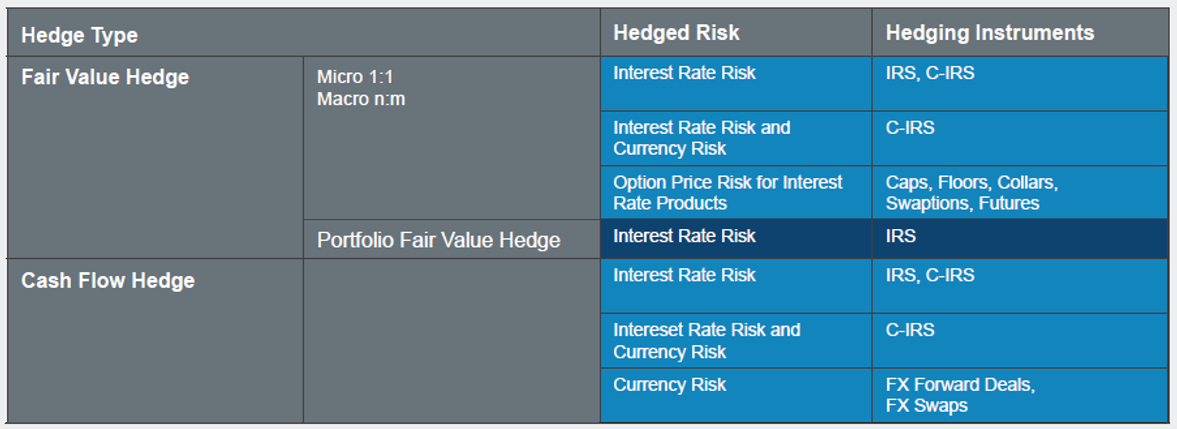

The following table shows hedged risks and hedging instruments for loans support by FlexFinance Hedge

Diagram: Hedge Types for loans supported by FlexFinance Hedge.

This also applies if the hedged deal is also otherwise valued at amortised cost or the value changes are captured as not affecting net income in the revaluation reserve.

The value changes of the hedging instrument and the hedged item are therefore recognised (largely compensated) on the balance sheet as affecting net income.

Safeguards against different types of risk can be implemented for one hedge. Jabatix Finance supports hedging against the following types of risk:

...