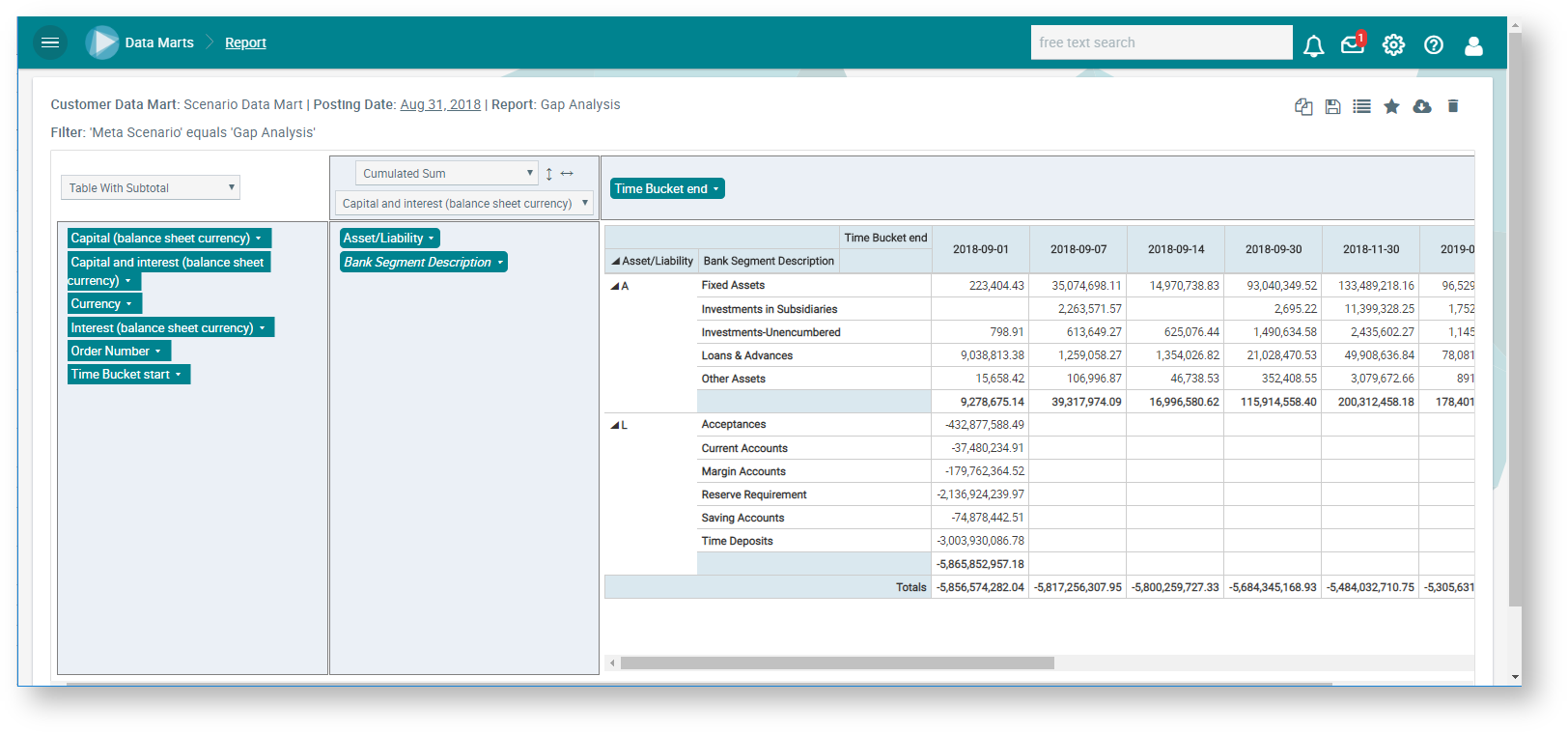

The Maturity Gap Report is used as the basis for the display, cf. Maturity Gap Report. In this case, the liquidity gap analysis is enhanced by scenarios for each deal type that reflect a bank’s expectations. For example, a holding period for 92% of the volume of savings accounts, which are usually shown as due on the next posting date, is simulated on the 3-year band on the basis of the bank's experience with shift scenarios. These scenarios can be configured individually without having to change the report. More information on the scenarios that can be used in this case can be found in Business Scenarios.