FlexFinance provides data marts for liquidity management that contain all the information needed to fulfil the requirements of the BCBS (= Basel Committee on Banking Supervision) for Basel III or the EBA (= European Banking Authority. The following reports can be generated, for example, on the basis of these data:

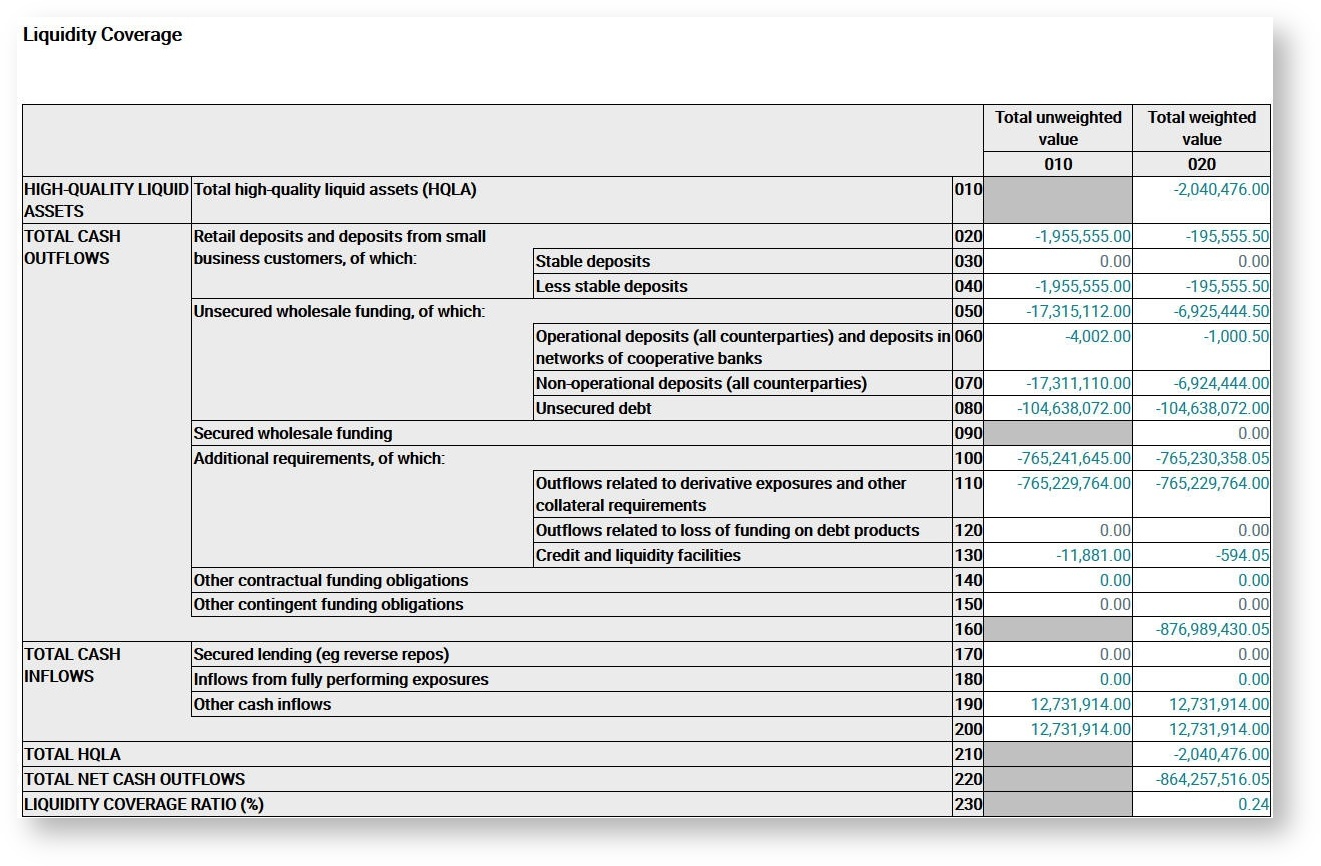

- LCR (Liquidity coverage ratio)

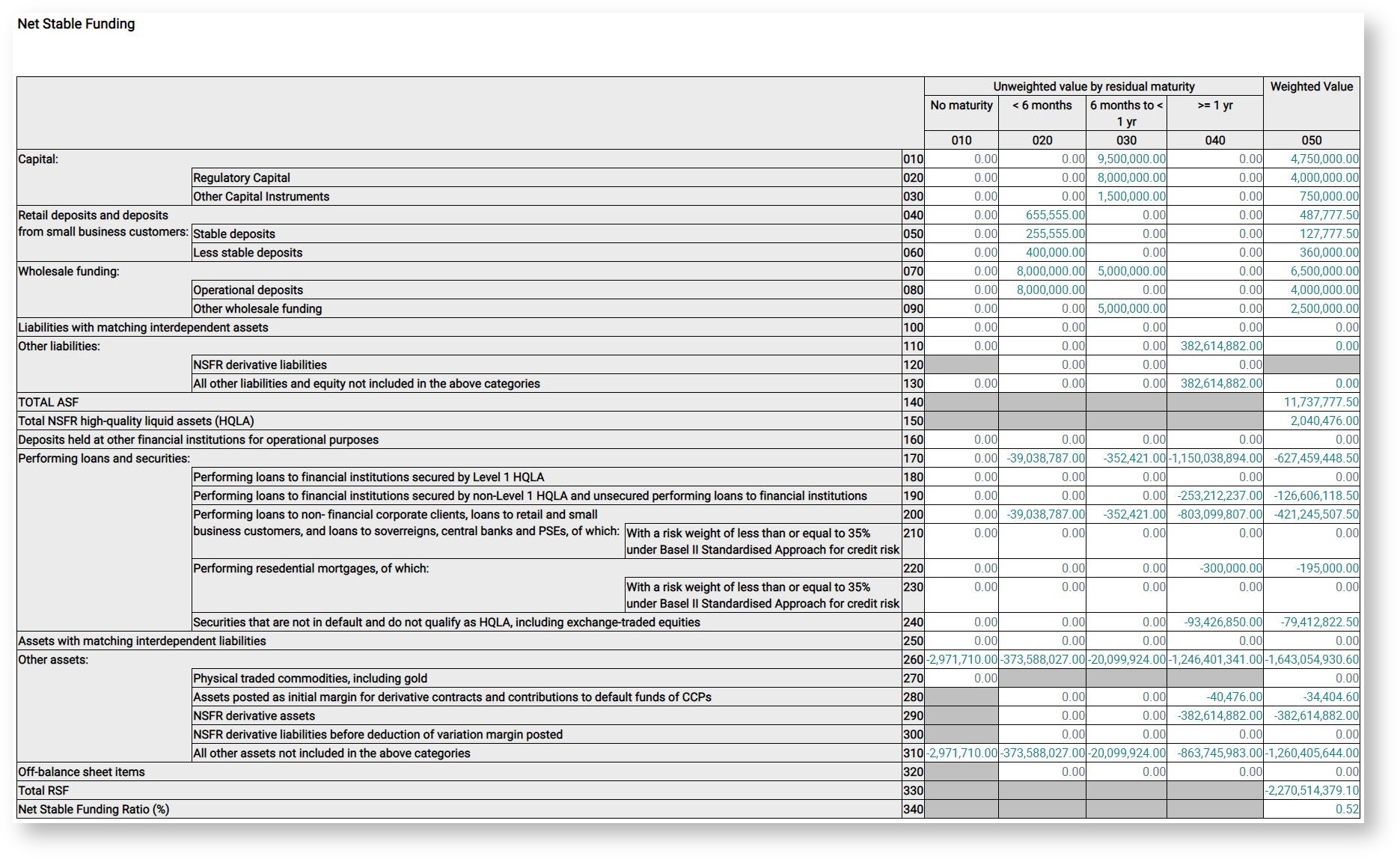

- NSFR (Net stable funding ratio)

- Contractual maturity analysis

- Financial planning

The aggregated values in the data marts are essentially calculated from the (future) cash flow plan for the deals. The cash flow plans are generated in FlexFinance from the contract information. Accrued/deferred amounts are also calculated and taken into account for the data marts. In addition, various models can be defined to simulate stress scenarios and their impact on future payments.

The data marts contain all the information required to differentiate between financial products and counterparties as well as all the individual components needed for the liquidity reports.

- Aggregated display for each period grouping (scale can be defined freely)

- Totals in the report currency (apportionable to each original currency)

- Subdivision into cash flow types (capital, interest, charges,...)

- Synthetic cash flows from the scenarios

- Default scenarios (customers and individual payments)

- Premature payments (prepayments)

- Development of market data (interest rates and exchange rates)

- Expected volume of new business

Below are some examples of liquidity reports in FlexFinance based on these data marts:

The following standard functions are also available for reports defined in FlexFinance:

- extensive drilldown possibilities

- possibility to compare the report for different posting dates

- proof of rule for reporting contents

- manual editing combined with consistency check