FlexFinance provides debit/credit entries, general ledger account balances and all valuation elements that have been used during the accounting process in specific data marts in the result layer.

In particular, the following analysis are supported for financial accounting:

- Online Balance Sheet and Online Income Statement (e.g. for IAS 1 reporting requirements). For an example refer to General Ledger/Shadow Ledger.

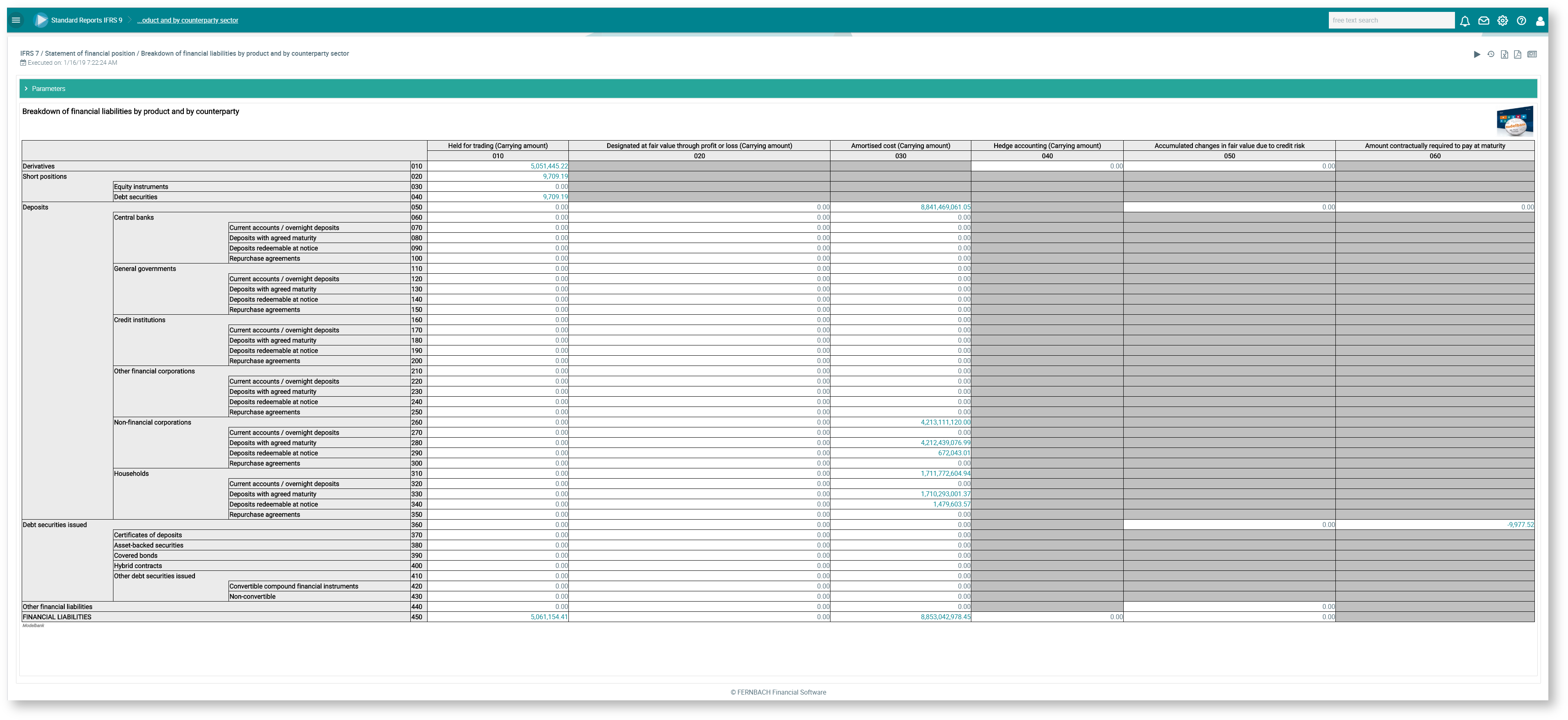

Financial Statements for the balance sheet and income statement, including analyses such as "Breakdown of financial liabilities by product and by counterparty"

Figure: Breakdown of financial liabilities by product and by counterparty

For each report, position breakdowns are available that are not limited by the design of the chart of accounts and that are not limited to specific pre-selected deal criteria. In general, all descriptive deal criteria can be used to create portfolios for the breakdown.

- Notes to financial statements such as IFRS 7 related reports

Figure: Selection of IFRS 7 Notes

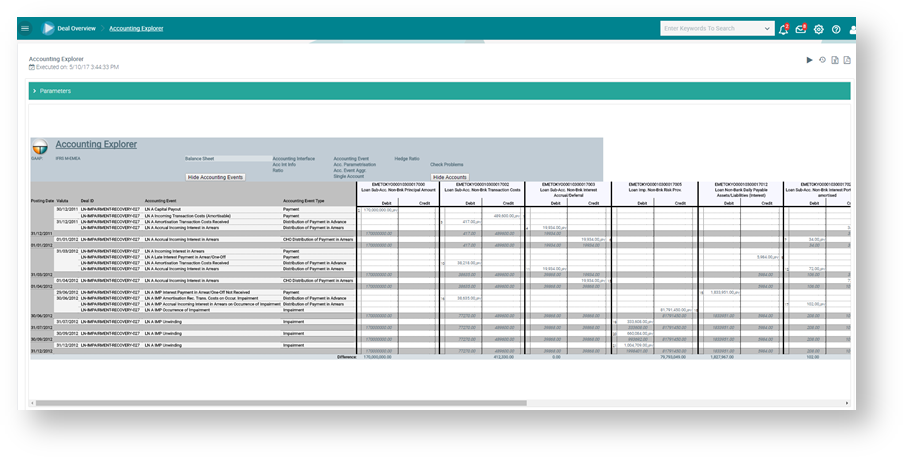

- Financial accounting at individual deal level shows all accounting events posted during the entire life cycle.

Figure: Accounting explorer for analysing accounting transactions and debit/credit entries at individual deal level

- For individual reports, data marts can be customised and analysed using different types of output such as tables, diagramms, cakes (see Data Mart Manager).

For example, data marts support- Proof of inventory for each account balance at individual deal level for balance sheet and profit and loss accounts

- Account statements including movements that explain the differences in account balances between two posting dates.

- Analysis of posted amounts for current and historical booking dates, providing drilldowns for all posted valuation elements to the underlying

- Explanations about calculation details such as the estimated cash flow plan that was valid at a certain point of time

- Recovery cash flows and sources of recoveries for specifc posting dates

- Details about the calculation of expected credit losses

- Analysis of debit/credit entries generated during the lifecycle of an individual financial instrument

- Account balances that can be broken down to freely definable portfolios and that can also be traced to individual deal level